Dale Pinkert: "The CPI Report is the Nail in the Coffin for TLT"

Coach on heading to 5.5% in the 10-year, the flight from the US dollar, the not-so-mag Mag 7, and why he sees big moves in oil this spring.

UPDATE FEBRUARY 14: Dale emailed me Feb 14 to let me know the Gold/Silver Ratio collapsed today, the dollar selloff gained momentum, miners are beginning to slide, and that he liquidated his NVDA puts and other bearish positions when SPX started threatening the 6100 breakout he discusses below.

_________________________________________________________________________

When TradeGateHub coach Dale Pinkert emails you to tell you he's monitoring "big things" happening in markets, you sit up, listen... and get him back on the show ASAP.

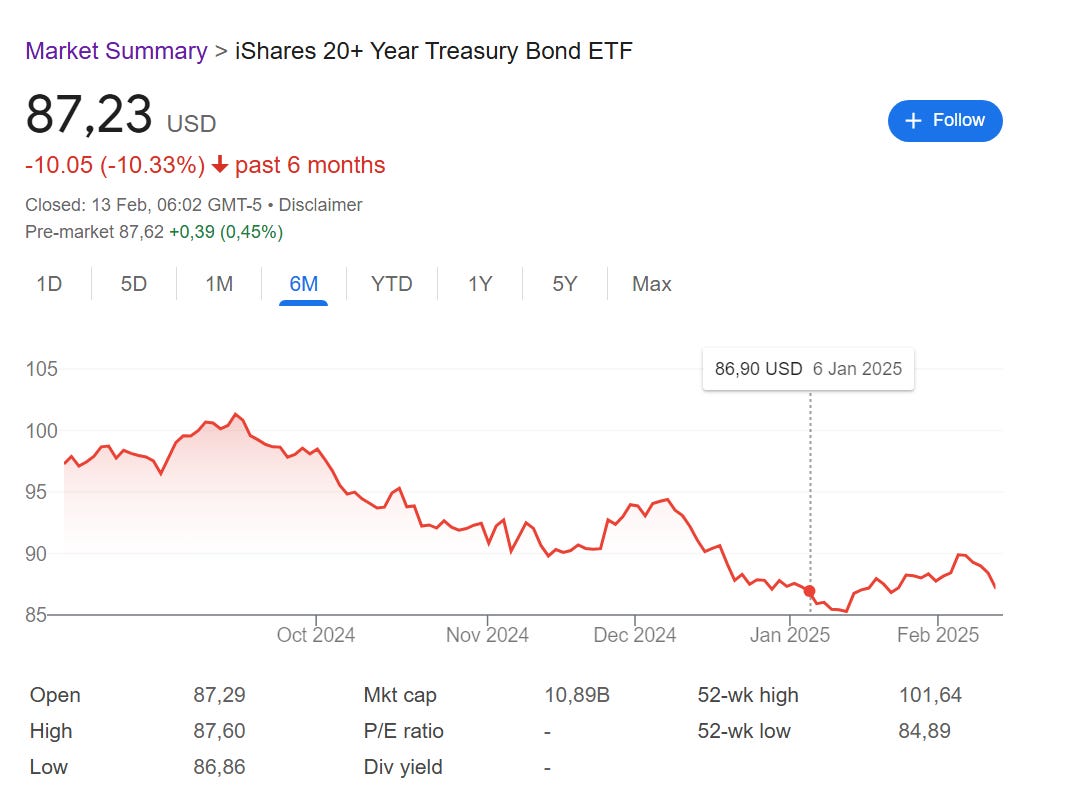

TLT: Heading to New Lows

Last time Dale was on (January 6), he said he could see TLT going down to the 70s, even though “I know people are going to want to put me in the loony bin.”

So, where are we now?

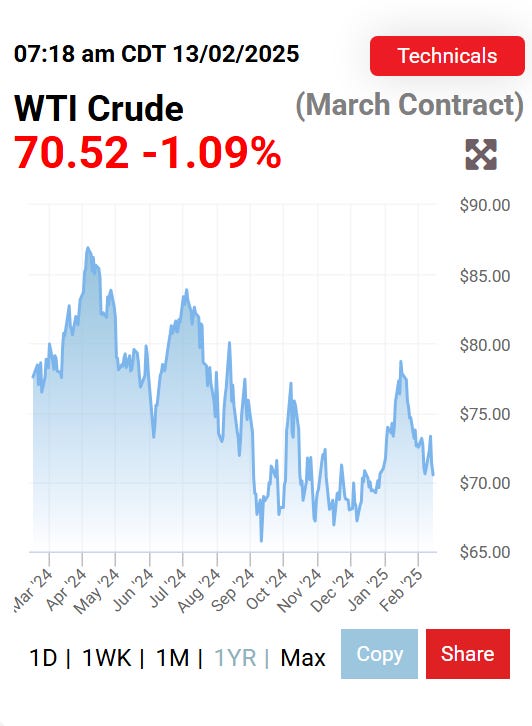

A snapshot first:

And then Dale’s chart:

“The move in the the CPI report was just the nail in the coffin [for TLT],” Dale said. “The other day, we were back testing the breakout - so Mr. Market was saying, ‘okay, you missed a major breakout, I’m going to give you another chance to buy it. Yesterday (February 11) we actually negated that breakout.”

Now, “we don’t have a head-and-shoulders, unless you want to call it a Quasimodo type of formation, which doesn’t exist,” he said. “It is my contention we’re headed to take out the $85 level… This whole range from $85 to $99 is 14 handles. So if we break down under $85, 14 handles is $71, which is going to be a sharply higher long bond.”

❗I say this all the time, but it’s really worth actually watching Coach going through the charts to get a handle on where he’s coming from.

💡 “I think we're headed towards not just 5%, but maybe 5.5% [on the 10-year] in the next several months,” Dale said. This chimes with Jeremy, Darius, and others

What about the fact that the administration wants lower yields? “Well, you know what, Maggie, I'd like to be 40 again, too,” Dale said. (We missed a big opportunity here to get Dale to sing this, tbh).

The US Dollar “Has Turned”

Last time, Dale said “I believe that we’re in the process of topping in the dollar, with a minimum target of $95 sometime by the summer.”

Where are we now? “The dollar has turned,” he said. “If we take out $107, it’s headed for $104.5. I still have the same forecast that we’ll see it under par this summer. This is embryonic, this is just starting - I think there’s plenty left in it.”

And yup, he thinks that even though with higher yields you might expect the dollar to explode. “There is a flight beginning out of the dollar,” he said. “The S&P hasn’t made new highs in a while, you’ve had the DAX making new high after new high, you had China exploding. This is all part of the currency play.”

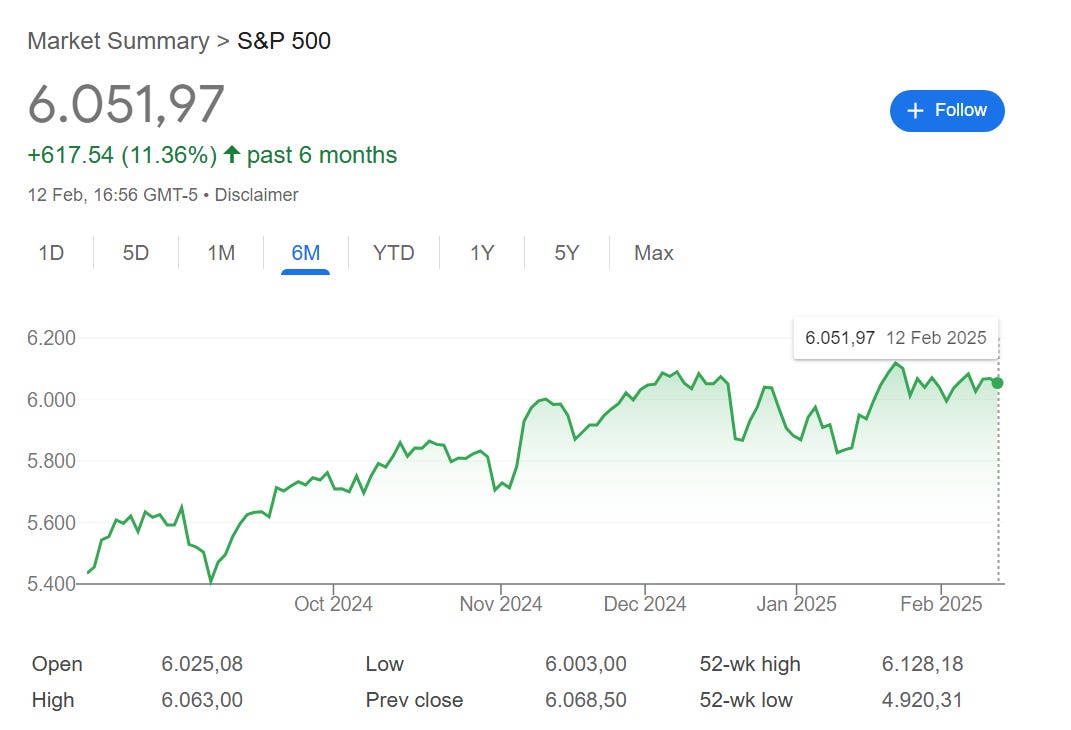

The S&P 500: Bearish

“I’m still looking for a correction in the US and I think it could take down everything,” Dale said. “But the next wave after this correction in the S&P could take it to 7,000. I was thinking that we should start heading down pretty soon, or I'm going to be wrong and I think we could have a sell-off into the spring, into tax day.”

The threat of possible recession and tariffs also aren’t great for stocks. Add to that the fact that the dollar hasn’t rallied on the spike in yields and hot CPI, and we’re back to considering that flight out of the dollar and US assets.

So what would take it from being a common-or-garden correction to something bigger? “5,700 is a line in the sand for this just being a generic correction to turning into something that’s 15% or more,” he said. “[But] if we get to 6,100, I’m out.”

Mag 7: Not so Mag

Here’s Yul Brynner Dale on:

Amazon: “It’s breaking.”

Apple: “Was the first one they took out to shoot. It could rally back to $250, but the top is in.”

Netflix: “Still okay”

Microsoft: “It’s been annihilated. It’s not gonna make a new high.”

Nvidia: “Has really taken some hits… I’m laying out Nvidia puts again, thinking that this is just a retracement of the break. If we start taking out $116 again, I can make a case for $70 Nvidia.” The reaction to Nvidia earnings next week will tell a lot.”

Google: Broke trend last week

Meta: The only one of the Mag7 doing well, pretty much.

💡“I'd sell the Mag7,” Dale said. “I think that what led the market up will also lead the correction.”

Gold, Silver, and the Miners

Gold: “It’s a tough trade to get long here, and a dangerous trade to get short.”

Miners: On January 6, Dale was starting to buy miners, and - well:

Looks like the dog did in fact have its day (this one is for you

)Now, if you bought the miners, “I’d be taking profits here, maybe a third” Dale said. “Book it, maybe we pull back to $37.”

Silver: “It’s been lagging, but the big event in metals to me this week was the topping of the gold/silver ratio at 92,” he said. “And that’s where you get 92 ounces of silver for one ounce of gold. And just last summer, it was 72. I’m looking for 50 long-term.”

💡Even with your physical [holdings], this might be the time to do a little switching - take some gold coins and convert it to silver,” Dale said.

🪢As long as you’re not trying to get it out of the Bank of England, of course…

Oil: Could Spike Higher, Even in a Bear Market

Everyone seems confident oil is going lower because the Trump administration wants it to and there is talk of ending the conflict in Ukraine, and people think Trump will negotiate a deal with Saudi Arabia, but Dale sees a more complicated route than that.

He would be a buyer of crude about $9 lower from where we currently are. But he thinks there’s a chance that Benjamin Netanyahu’s visit to the White House wasn’t just about Gaza but about “battle plans for Iran.”

“Netanyahu’s lifelong mission has been to prevent Iran from having a nuke,” Dale said. “[And] Trump believes that they attempted to assassinate him. The second Gulf War, when we went into Iraq, one of the reasons was that Saddam Hussein had threatened President Bush’s father. So I do think that there’s going to be some military action in the Middle East this spring. We could go from $62 to $100 in a short period of time… But longer term, I think it’s a bear market still.”

And Finally…

“Wear earplugs and trade your levels,” Dale said. “People who buy headlines today sell newspapers tomorrow.”

Not dissimilar to our other chart whiz,

, who told us back in January, “This might be a good year to pretend that you're living under a rock and that the only thing you see is price and charts.”To watch the full episode, right this way.

Enjoy,

Maggie

Important Disclaimer: It is crucial to remember that this article is for informational purposes only and should not be considered investment advice. Consult with a qualified financial advisor to assess your risk tolerance, investment goals, and overall financial plan.

Great summary Maggie.

Excellent, as always