Jeremy Schwartz: "The More Impactful Elon is with DOGE, the Lower Rates Will Go"

The WisdomTree CIO on where 10-year yields should be, the impact of DOGE, why inflation is lower than we think, and opportunities in Europe.

Talking Markets was on the road yesterday, and Jeremy Schwartz, Global Chief Investment Officer of WisdomTree Asset Management joined me to digest the jobs report and dig into everything from DOGE to Europe to the latest on earnings season.

The Jobs Report & What It Means

Yesterday’s jobs report was pretty mixed, with job growth slowing more than expected but the unemployment rate going down. Kind of like a Rorschach test where you can see whatever you wanted in it.

Here are Jeremy’s thoughts on the report and what it means…

The jobs report was “healthy.”

The Fed’s neutral rate “might be one or two cuts away from where they are today.”

“Positive news might lead to higher rates” and the 10-year yield “could actually get towards 5% or above.” That “might be a little bit challenging for the market, but it is the sign of a healthy economy.”

🪢Reminder: Darius and the 42 Macro team think the 10-year is priced too low until it gets to 5.64%, while Cem Karsan thinks they could get to 6% or higher this year.

And if the 10-year goes to 5% or higher, the “dollar can go higher,” Jeremy said. “They’re definitely part of the same trade… One of the things I tell people from an investment perspective is that most people don't have enough strong dollar exposure in their portfolio.”

There’s more that could lead to a stronger dollar, too, despite the speculation that President Trump wants a lower dollar. “It comes back to policy,” Jeremy said. “So if [Trump] does more tariffs, it'll be a stronger dollar. If he has higher rates, it's going to be a stronger dollar.”

Inflation Update

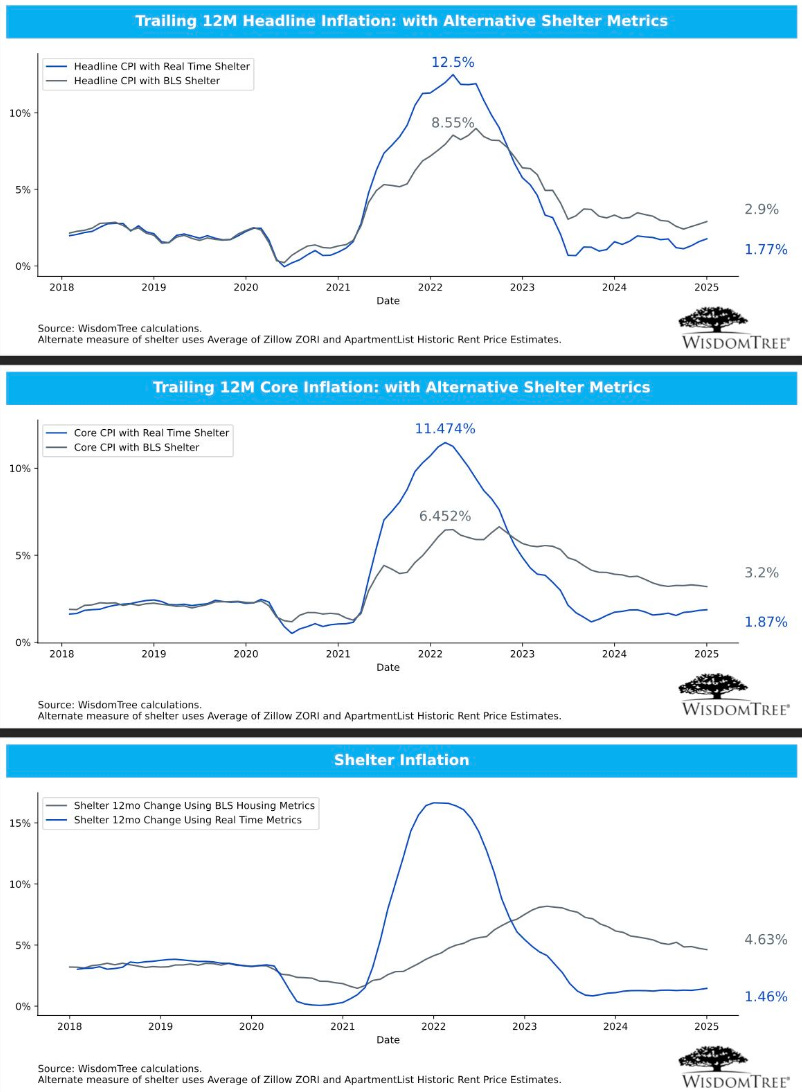

WisdomTree uses alternative indicators for inflation - basically, they plug in more real-time data on shelter by using data from ApartmentList and Zillow.

“If you look at ApartmentList trends by itself, that number over the last 12 months is negative. You're seeing rental deflation in apartments, whereas the BLS shows shelter inflation up almost 5%,” Jeremy said. “So when you do an average of the Zillow and the negative deflation you get in Apartment List, I have core inflation at 1.7, 1.8%.”

What About DOGE Impact?

“I do think they can cut spending,” Jeremy said. “The question is, will they cut a trillion dollars in spending like they would like, or even more? I think it's going be hard.”

Additionally, he pointed out: “Those things have a compounding effect. You cut spending, that means there's less money in the economy. That is a drag on growth. There's less deficit borrowings, that's lower rates. So it does have a compounding effect that the more impactful Elon is with DOGE, then the lower rates will go.”

“Now our view is the economy has been strong, we should get a 5 % yield,” he explained. “So part of our bias is that rates are tending higher because of the strong economy and that Trump wants to cut taxes. so that is is deficit expanding. So the question is how big will be any further tax cuts? Or is it just the extension of the tax cuts? That all will remain to be seen.”

What Does This Earnings Szn Tell Us?

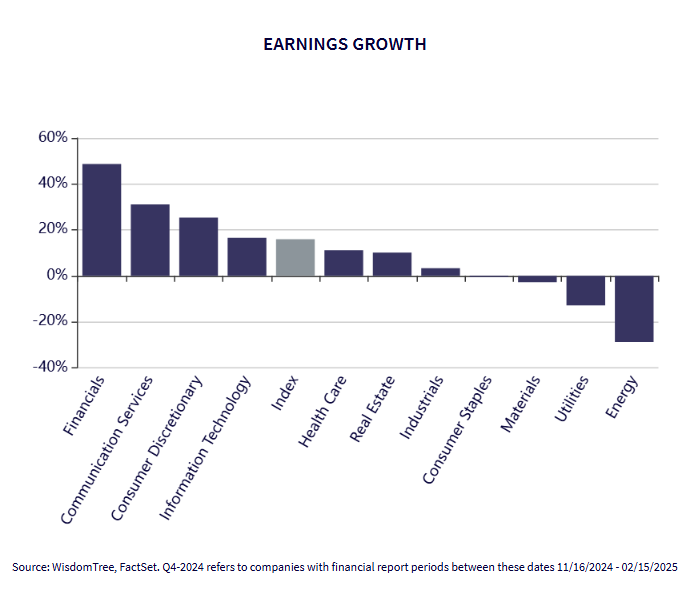

Around 300 of the S&P has reported so far, and it’s actually “been a very good season,” Jeremy said (even though Amazon disappointed yesterday).

🪢WisdomTree has a tool where you can crunch this data different ways, called the Path Earnings Tool. Snapshot below of and direct link here.

A lot of eyes are on the Mag7, but Jeremy pointed out something interesting happening in the small cap space: “Last year, you had this big small cap under-performance and it’s because their earnings were declining,” he said. “Now, [of the small cap companies that have reported], their earnings growth is 12%, so that’s a very big positive… That's sort an interesting anecdote that small caps are definitely doing better as part of that broad story.”

💡“The cheapest segment of the market is the small caps,” he said. “These companies actually are now starting to grow. And so if you get this environment where they do surprise on the upside, there is definitely valuation expansion room on lot of those areas.”

Europe

We’ve had some mixed opinions on Europe over the last while on Talking Markets - everything from “it might break up” (Doomberg) to “it could get back to a position of strength” (Jacob Shapiro) to “pockets of opportunity” (Peter Boockvar).

“To start the year, Europe's been performing very, very well,” Jeremy said. “Now the question is, is Europe performing well to start the year because tech has been lagging and they don't have as much tech? Or because there might be a resolution in Ukraine? If you can get a resolution there, that’s a big positive catalyst. That’s the wild card.”

Another wild card of course is potential tariffs on Europe.

💡“From a stock perspective, there are some opportunities,” Jeremy said. “There's definitely some interesting value plays in Europe. Nobody has wanted to allocate there. Everybody saw the US as the only game in town. I do think the resolution [in Ukraine] is a key critical [catalyst] to really get people excited. But the valuations are extremely supportive. So it comes back to when things are so low priced, they don't have to be great. They just have to be less bad.”

To watch the full episode, right this way.

Enjoy,

Maggie

Important Disclaimer: It is crucial to remember that this article is for informational purposes only and should not be considered investment advice. Consult with a qualified financial advisor to assess your risk tolerance, investment goals, and determine if an allocation to oil aligns with your overall financial plan.

Hi Maggie! I just read a very interesting article by Jesse Felder. If you could get him on, I think it would be very interesting.

His intro to the article is:

There seems to be a great deal of confusion around the intentions of the new administration. Many are asking what does President Trump hope to accomplish with all of this upheaval? Looking at every new policy announcement on its own, it’s easy to get confused. It’s only when you take a step back and look at them all in concert with one another that these individual trees begin to look like a very homogeneous forest.