Jacob Shapiro on the Future of US-China Relations

What the DeepSeek news means for US-China relations, why the new president may be an imperialist rather than an isolationist, and developments we need to watch in Europe, Latin America & more.

What accidentally perfect timing to have Jacob Shapiro, The Bespoke Group Head of Geopolitical & Macro Research (and writer of

here) on Talking Markets yesterday…First Things First: DeepSeek

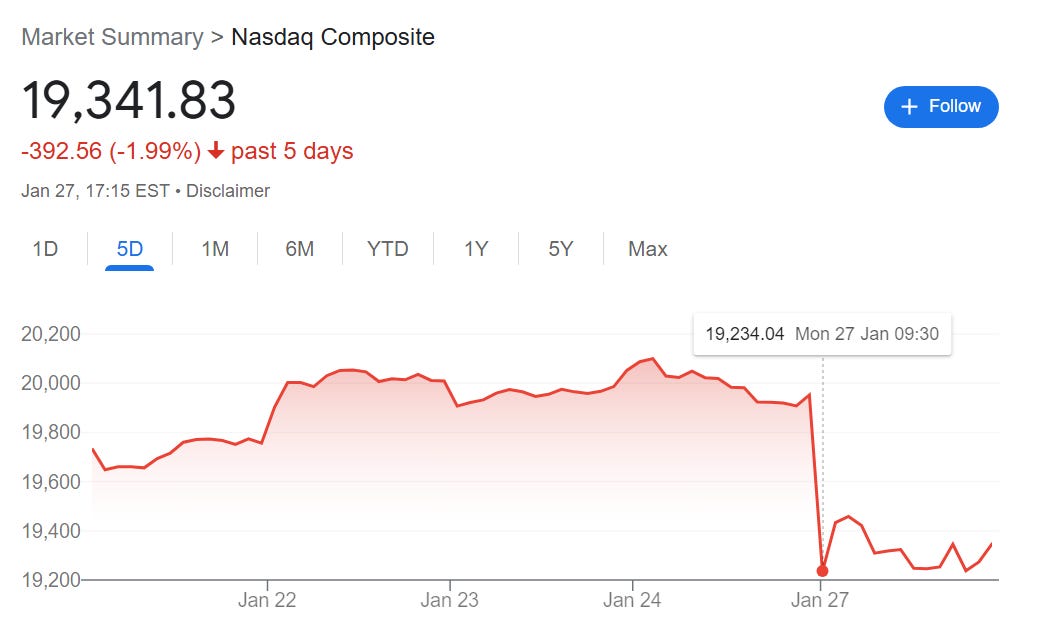

In case you were out in the desert with no phone service yesterday, news that China’s DeepSeek created a competitive open source AI model for Very Little Money completely freaked out markets and investors. By the end of the day, $1 trillion dollars had been wiped off the NASDAQ.

NVIDIA was hit particularly hard, and even though, per Vanda Research, retail investors bought record amounts of NVIDIA yesterday, it wasn’t enough (h/t

) :US President Donald Trump called it a “wake up call” for the US tech industry, while OpenAI CEO Sam Altman said it is “invigorating to have a new competitor.”

So, was wiping one trillion dollars off the market an over-reaction?

Jacob pointed out that unless you’ve been levering up to buy NVIDIA (as an example) or you’ve only bought in the last month, you’re still doing great. This is true - NVIDIA’s drop yesterday brough it back to the same price it was… 4 months ago, in September.

Also, it shouldn’t reeeeally be surprising that China is going to be good at AI: “They have more data than any of us,” Jacob said. “They have a billion plus people and an authoritarian government willing to do whatever they need to do to gather the data.”

Jacob cited Ben Thompson’s post at Stratechery and Karen Hao on Twitter (link to thread) whose TL;DR is that yes, the DeepSeek news is important but some of it was announced weeks and months ago, and that the market freakout was in part an emotional spasm and in part a response to what this all means for the US-China relationship.

We will see what happens today.

US-China Relations

What it all means for US-China relations is important. Marc Andreessen, for example, called it AI’s “Sputnik moment,” bringing some Space Race-y language to the game.

Except the US-China relationship is way more interdependent than that, which means it’s not as simple as a race one side is going to win.

“A lot of the cutting edge research and the best ideas [are] still happening in the US,” Jacob said. “But it’s China who actually makes things in the global economy. You're dealing with a country responsible for making 30% or 35% of the things that are actually made in the physical economy in this world.

So, Jacob says, “Both sides have each other over a barrel. China needs access to US markets and to US intellectual property, and the United States needs access to Chinese markets and to all of the things that are made in China and all the supply chains that have China either at the front end, or the second or third tier. So there’s this sort of mutually assured destruction thing that happens if you completely double down on it.”

Jacob pointed out one sign we have on what may lie ahead for US-China relations - President Trump said he was going to enact tariffs against China the day he was elected, but he didn’t. “Instead, he launched an investigation into whether China had fulfilled its requirements in the phase one US China trade deal,” he said. “We know they didn’t. So he was buying time. That tells me that maybe Trump is trying to get a deal. And he has a willing partner in the Chinese. The Chinese economy is in a terrible state.”

The Reindustrialization of the US

The broad-ranging “Make American Great Again” agenda could see some success if the Trump administration focused on a couple of key industries and making them secure from that perspective, and subsidized the costs “so the US consumer isn’t suddenly paying 10x for these things,” Jacob said. “But that's not what I'm seeing. I'm seeing internal dissent within the Trump administration itself about, are we going to be fiscally conservative or are we going to let the good times roll.”

Nearshoring, Not Reshoring

Overall, Jacob says: “Reshoring is not going to happen. I don’t think the US consumer is prepared for inflation at 30 or 40 % or whatever it would be to really reshore these industries.”

However, he added: “Nearshoring absolutely can happen and already has been happening, has been happening to places like Vietnam, India, Mexico.”

💡“It’s one of the reasons I'm really bullish countries like Mexico, like Indonesia, like India,” he said. “These were all countries that could not compete with China in a globalizing world, [but] now that political calculations are involved, ‘okay, now we’ll spend a little bit more money to put the factory in Mexico and we’ll have our cake and eat it too.’”

An Imperialist Outlook?

Jacob previously framed President Trump as an isolationist, but actually he thinks he has more of an imperialist bent:

“Some of the things that Trump is talking about right now, they're not out of the general frame of US foreign policy,” Jacob said. “That was classic US foreign policy imperialism in the early 1900s. And that's what it looks like to me - ‘Greenland has resources. I would like to buy that. Panama has a canal that we want to use. I would like that. And I will use my economic power to get it.’”

Still, Jacob echoes multiple guests we’ve had on Talking Markets recently by saying that it’s tough to really forecast where President Trump is going (or as Ben Miller said on Friday, “you can’t forecast a person.”)

“He has the sort of contrarian nature to him,” Jacob said. “And I feel very, very unsure about where we're going over the next couple of months, even if I feel pretty good about where we're going from a trajectory perspective on a longer term time horizon.”

Around the World

As ever when Jacob joins us on Talking Markets, we go full Jules Verne, so let’s take a quick trip:

Colombia

Before DeepSeek hijacked the newsflow, the spat between Colombia and the US was the big weekend news. Again, if you were out in that desert - Colombia refused to accept US military planes carrying Colombian deportees; President Trump threatened immediate tariffs of up to 50%; Colombia backed down.

Jacob said the spat showed that “Trump was willing to throw long-standing historical ties with Colombia out the window.” And, given that Colombia’s biggest export to the US is oil, “maybe President Trump feels like he can be more muscular with these countries” given he wants to increase US oil production and therefore be less reliant on others.

So, the Trump administration will see this is a victory, but Jacob cautions: “It’s really irresponsible. Yes, you will get some people to fall in line, but you're also going to isolate people. And you're also going to create opportunities for your enemies to pick off some of these countries to become their friends rather than yours… At a certain point, Trump [may] pull that with a country that says ‘Fine. We’ll go try our hand with China.’”

And that has already started, even before Sunday’s events:

Europe

One of the key Q1 events in Europe will be the German elections, Jacob says. “If the polls hold, they're probably going to get a strong center, right government. Europe needs it because Macron is completely handicapped by his election gamble that blew up in his face.”

If that happens, Germany might “wake up and put the European Union back in some of sort of position where it’s operating from a position of strength. Whereas right now, it’s on the back foot.” And that position of strength could involve a strengthening relationship with China.

Ukraine

It’s “very difficult” to see a resolution right now, Jacob says. “I think it's fair to say that Russia is winning the war right now. I think you have seen Ukraine at least come to terms with the fact that it's not going to be able to regain Crimea or the Donbas and things like that. And so for them, it's about securing some kind of assurance that the war, if not over is a frozen conflict, and then that they're going to have the requisite support that they need, especially from Europe.”

But that kind of acquiescence doesn’t seem immediately likely: “For the war to end or get to a point where you could see consolidation of the current gains, the Kremlin has to decide that either it can't do anymore and it has to get out or because they think they can get something that is worth their while for it,” Jacob said. “And that's why I say I don't see a resolution anytime soon, because I don't see either one of those things happening.”

US Neighbors

“If Trump burns up the US-Mexico-Canada free trade relationship, then we’re in a worst case scenario,” Jacob said. “Things could get really bad and inflation could get really scary. But I don’t see that happening. I think he is trying to get a deal.”

If they don’t made a deal, “they’re in a fantasy world and they’re going to break US policy,” he added. “I think they’re smarter than that.”

To watch the full episode, right this way.

Enjoy,

Maggie

Important Disclaimer: It is crucial to remember that this article is for informational purposes only and should not be considered investment advice. Consult with a qualified financial advisor to assess your risk tolerance, investment goals, and determine if an allocation to oil aligns with your overall financial plan.

Pragmatic analysis, ty.