Darius Dale: Bonds are “Woefully Priced for Higher Inflation”

The 42 Macro founder and CEO on sticky inflation, why 10 year yields "should be" 5.64%,, looking at 2025 through the lens of "the 3 S's," and more.

42 Macro founder and CEO Darius Dale joined us on Talking Markets for the first time yesterday (January 13), and brought the big chart and data analytics guns to the table (as he always does…!)

2025 Big Picture

It’s a tough year to predict.

Darius put it this way:

“I would say 2025 is a year in which the distribution of probable economic outcomes is both wide and widening. If we have a significant amount of uncertainty develop from an economic and policy perspective, we may actually see a trending volatile choppy market and potentially even a crash.”

Which reminded me of how

put it in our conversation last week:“I think that we're into a bog of uncertainty that we probably haven't seen in 60 years. Every forecaster should be humble enough to realize that the error term around any forecast for this year is much wider than it's been in the past.”

Add to that, “we are in a very asymmetric point in the positioning cycle,” Darius said. “Investors are on one side of the boat, the very bullish side of the boat right now.”

So in other words, one of the only things we really know about this year is that we don’t really know. But investors are certainly acting like they do know. What could possibly go wrong(?!)

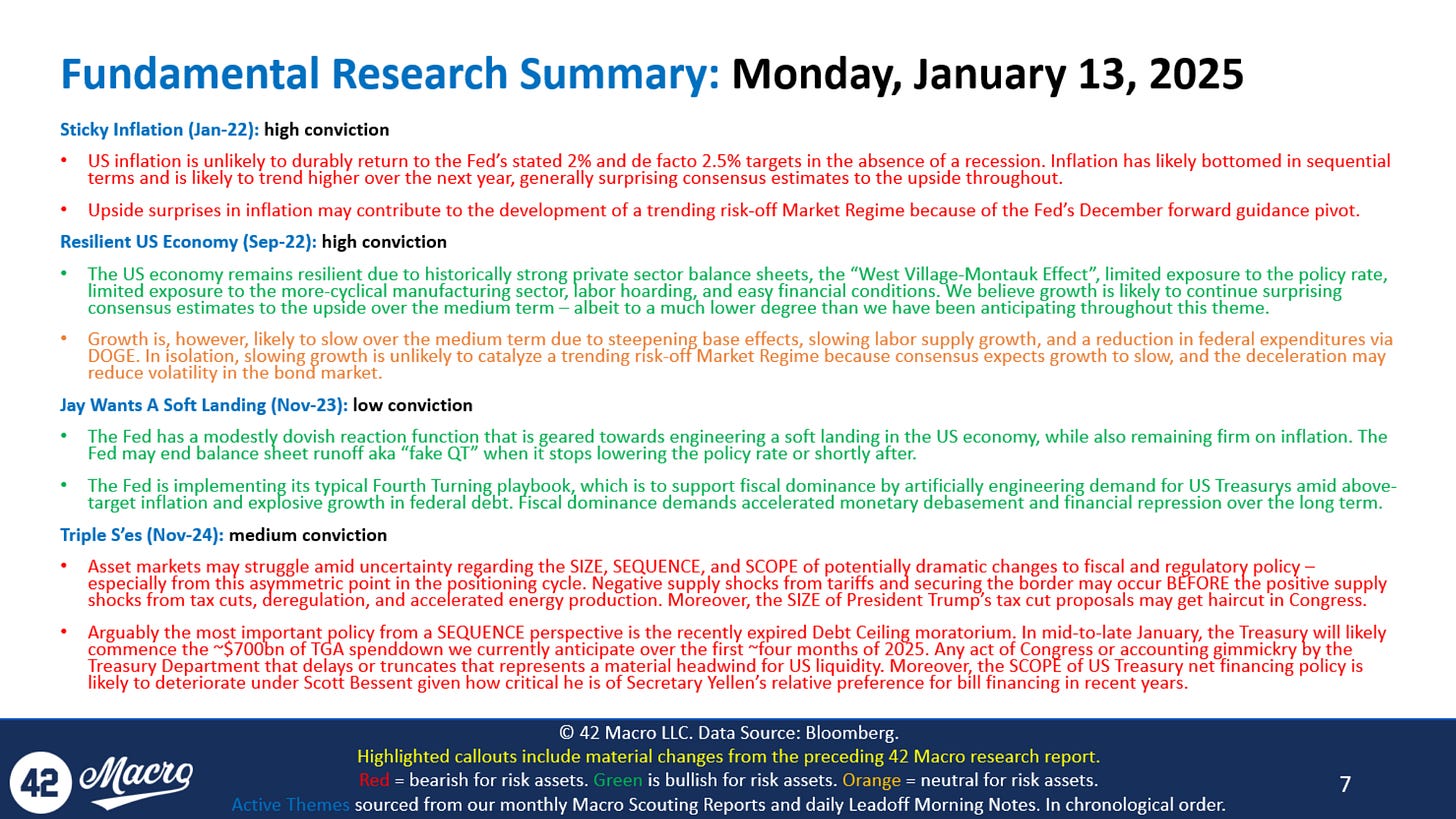

Snapshot of 42 Macro’s Themes

Darius generously shared some of the key themes his team have been keeping on top of:

Sticky Inflation

Darius and team have been in the sticky inflation camp since January 2022, and think that “we’re not going back to 2% or even 2.5% on a durable basis, in the absence of a recession.”

No inflation breakdown without recession: 42 Macro have studied each of the 12 post-war US business cycles, and found that inflation tends to be the most lagging indication of the business cycle. It typically breaks down durably below trend 12 to 15 months after recession “And so, with this being the history of the entire post-war history of the US economy, we should not be expecting a durable breakdown in inflation,” Darius said.

No real signs of recession: Darius said his models show that “recession continues to be a low probability over a medium term time horizon.

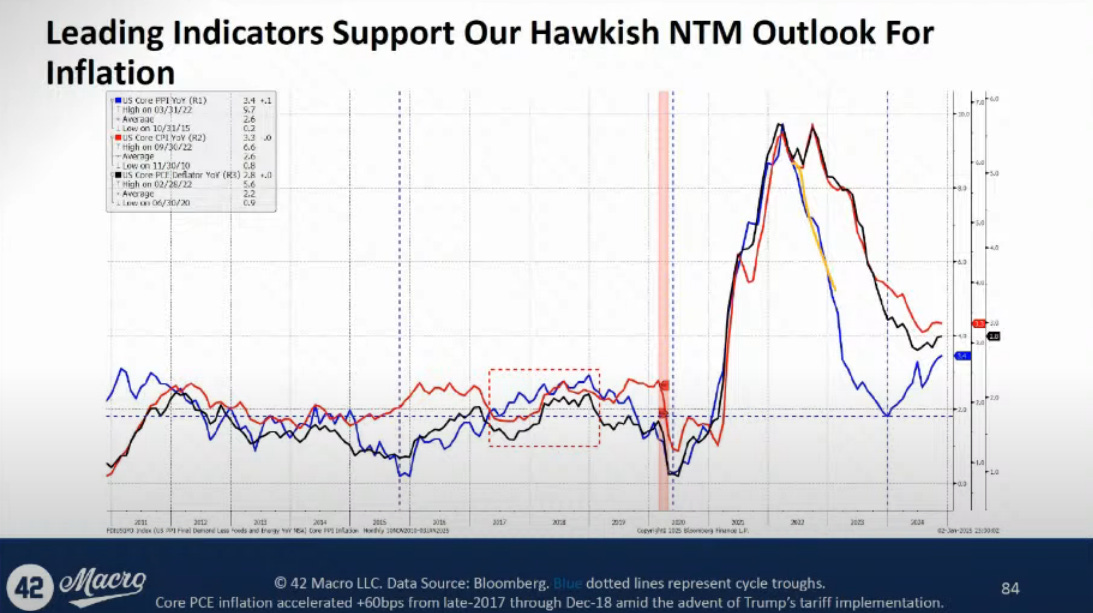

Key indicators backing up this view: In the chart below from 42 Macro, US Core PPI is purple, US Core CPI is red, and US Core PCE is black. You can see them all trending higher over the last year:

Other likely inputs: A reacceleration of wage growth “which is a high probability if we close the border,” which will be passed on to consumers “in the form of faster CPI, faster core PCE inflation,” Darius said.

TL;DR: “We have inflation kind of meandering higher in the first half of [2025] with a meaningful acceleration in the middle of the year, before settling out at a higher level in the second half of the year,” Darius said. “We're not calling for inflation to have this significant acceleration back towards 9%, like what we saw in 2022. We're just saying it's probably closer to the bottom of its side curve and will meander higher over the medium term. And that is moving in the wrong direction relative to both consensus projections and the Fed's projections.”

Bonds are “Woefully Priced for Higher Inflation”

Darius thinks we’re currently in a fourth turning. In case you haven’t come across that before, here’s Perplexity’s definition:

A "Fourth Turning" is a crisis period in the cyclical theory of history proposed by Neil Howe and William Strauss. It is characterized as an era of secular upheaval and decisive change, typically lasting about 20-25 years. During this period, institutions are destroyed and rebuilt, and there is often a perceived threat to national survival. The Fourth Turning is marked by major societal transformations, potentially involving war, revolution, or other forms of widespread conflict.

Darius and team did a deep dive on what you should expect as an investor during a fourth turning, with one of those expectations being higher equilibrium levels of inflation. The problem? Darius thinks the bond market is “woefully and inadequately priced for higher levels of inflation.”

Looking at the term premia on 10-year Treasuries, which is currently at 63 basis points, Darius says:

“Throughout most of the post-GFC crisis era, we had negative term premia, “which doesn’t make any sense,” he said. “You should be getting paid to take a liquidity risk in your portfolio, not paying the bond market.”

It’s normalizing now, but Darius thinks that in a fourth turning it should actually be higher than normal.

42 Macro built a model that prices what the premia should be. “We just subtract the deviation from the long run mean of term premium from the 10 year and we wind up with a rate of 5.64%,” he explained. “So in our opinion, the 10 year treasury yield is richly valued and the bond yields are too low up until the point where they get to 5.64%.”

The resilient economy could handle 5.64%, Darius said, but the markets? “Probably not.”

Timing Matters: The 3 S’s

Pretty big changes to fiscal and regulatory policy are going to happen this year, Darius expects, resulting in both positive and negative shocks to the economy.

On the negative supply shock side, potentially: Stuff like tariffs, securing the border, spending cuts, a hawkish shift in Treasury net financing policy*

On the positive shock side, potentially: tax cuts, deregulation, accelerated energy production

*“It's very likely that Scott Bessent shifts us from overly allocated towards bills to issuing a lot more coupons on a relative and nominal basis than Janet Yellen had,” says Darius.

💡Size, Scope, and Sequence: With positive and negative shocks incoming, these are the 3 S’s that matter. “We're going to get a lot of good stuff, and we're going to get a lot of bad stuff,” Darius said. “It's about the order in which we get the good stuff versus the order in which we get the bad stuff. If we get good stuff first and bad stuff after that, you could probably see markets do well and then sell off to account for the bad stuff. Or vice versa, if we get a lot of the bad stuff first and then followed by the good stuff, [I] can potentially see markets do quite poorly until we start to see the whites of the eyes on tax cuts and deregulation.”

Add to that, the fact that investors are heavily weighing down the bullish side of the boat at the moment juices the risk of a disorderly crash: “People are very much betting on positive outcomes,” says Darius. “I think you could potentially have a crash in asset markets if we get all the bad stuff concentrated first or clustered together.”

So we’re back to the big picture: 2025 is going to be tricky. Here’s Darius:

“This year is going to be very difficult and very tricky for investors to risk manage. I highly recommend that you have some proven quantitative risk management systems to help guide your portfolio in a year like this, because it's not going to be as easy as it was last year.”

To watch the full episode, right this way.

Enjoy,

Maggie

Important Disclaimer: It is crucial to remember that this article is for informational purposes only and should not be considered investment advice. Consult with a qualified financial advisor to assess your risk tolerance, investment goals, and overall financial plan.

Great summary as usual 🙌