Mish Schneider: “Might Be a Good Year To Pretend You’re Living Under a Rock”

If you're looking for trade idea generation, the MarketGauge.com Chief Strategist ALWAYS delivers.

MarketGauge.com’s Chief Strategist Mish Schneider joined us yesterday (January 15) for her first Talking Markets session of 2025, and if you’re looking for trade ideas to investigate, she’s got a ton for you. Let’s dig in…

The January “Trend Trade Reset”

What is the January “trend trade reset”? Well, it’s a calendar-based strategy Mish and co have been using for more than 20 years, which highlights January and July as key reset points for markets. And “it happens to be particularly powerful [in] the January of a new administration,” Mish said.

Based on this strategy:

Monday's low could mark the January low, which could become the six-month calendar range low.

Key levels, such as the January high for small caps, remain crucial indicators.

Once the first 10 trading days of the year are in the books, “we will have a much clearer idea of what breaks out,” Mish said.

“All About Price This Year”

“This might be a good year to pretend that you're living under a rock and that the only thing you see is price and charts,” Mish said. “We know this is a very headline-oriented administration coming in.”

Like Jared, Mish thinks that some of president-elect Trump’s headline-makers are negotiating points, and so we shouldn’t necessarily think he’s being literal: “If you start at this outrageous point, then there’s a negotiation that [happens].”

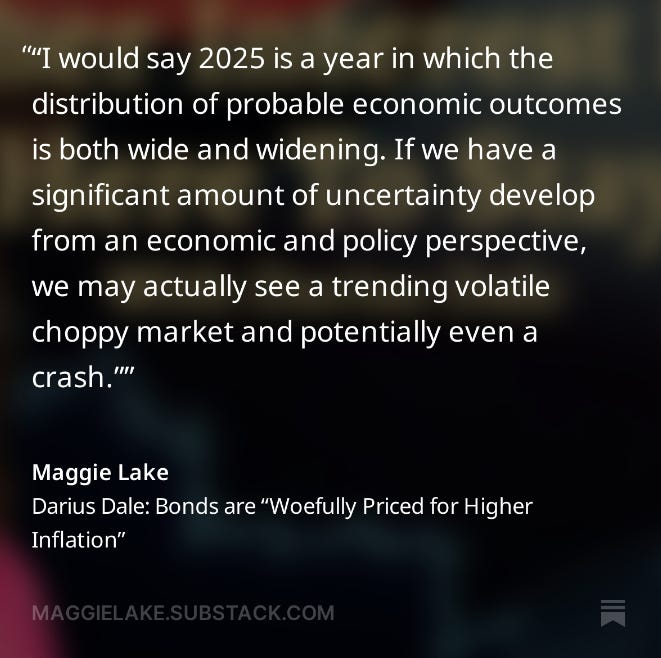

Mish is also on the same page as Darius when it comes to the dispersion of probabilities this year:

💡Mish’s ‘Live Under A Rock’ Rule: In headline- and emotion-driven times, focusing on the charts and price action helps you become more dispassionate.

Commodity Supercycle?

“The supercycle didn't happen in 2024, but I said 2025, 2026,” Mish said. “I kind of put it on the shelf because of price thinking maybe I'm wrong. But now I'm starting to see that might emerge again.”

Commodities Mish is interested in for 2025:

Oil: “If it breaks out over $80 [a barrel], we're definitely talking more inflation.”

Gold: “It has been solid as a rock for the last couple of years, partly as a risk, a flight to safety, partly as an inflationary tool.”

Silver: “Starting to show signs of starting to outperform a little bit. That's inflationary.”

Copper: “Making a little bit of a comeback here.”

Corn: Has experienced a breakout to $475

All of this makes Mish think that stagflation is still a possibility, with the LA fires and the collateral damage from that in terms of government spending, resources, and rebuilding adding to that thesis.

“Me, Not We”

Mish remains “extremely interested in the trickle effect of the diet drugs,” With Novo Nordis, Elf, and Ulta all on her radar. “Things that have to do with beauty, skincare, makeup, exercise, supplements, diet,” she said “I think the consumer is shifting to that. From ‘we’ to ‘me,’ which I stole from Muhammad Ali.”

Made in America

How much the “Made in America” reshoring plan will come to pass is a wait-and-see game, but Mish is “definitely excited” about it, particularly in the realm of automation.

‘Made in America’ stuff she’s looking at:

Chemours: They make Teflon… but also chips

IBM: “It hasn’t done much yet, but I think it has potential

Rivian: “People probably think I’m nuts to keep talking about [EVs], but I do think Rivian has tremendous potential upside and very limited downside.”

Stratasys: A manufacturer of 3D printers - they made a “huge” deal with Nascar “and yet the stock is just sitting there at around $9 a share.”

Crypto

The three main alts Mish thinks “have great potential” this year are Ripple, Solana, and Chainlink.

As for Bitcoin, it fell right down to its 50 day moving average before rebounding to $100,000, which was “almost technically perfect,” Mish said. “I still think that Bitcoin is gonna go up. I think it could be a little bit volatile because that's the nature of the beast, but in my 2025, I projected $130,000 to $150,000 at the end of the first quarter.”

AI

This year, Mish is focused more on the software side of AI than the hardware (e.g. chips, etc) side. Stuff she’s interested in:

Google: “The chart looks great”

Snowflake: An AI data cloud company - “The chart looks good”

Salesforce: Their Einstein AI is directly embedded into the Salesforce platform

Ulta: On the retail side, they’re getting deep into AI for their tools and services

And Finally…

“Being politically charged is not gonna serve you in making money. It's not gonna serve me and it's not gonna serve you,” Mish said. “So put those blinders on and just look at price.”

To watch the full episode, right this way.

Enjoy,

Maggie

Important Disclaimer: It is crucial to remember that this article is for informational purposes only and should not be considered investment advice. Consult with a qualified financial advisor to assess your risk tolerance, investment goals, and overall financial plan.