Jared Dillian: "If an Economically Unfree Country Becomes Free, You Have Explosive Growth"

The Daily Dirtnap author on the "new Javier Milei," the stock he's short "out the wazoo," why he thinks the bond sell off is "overdone," and why people misunderstand Trump on tariffs.

The Daily Dirtnap’s

is never afraid to be contrarian, and he had some pretty damn contrarian ideas for us on Talking Markets on Friday (January 10). We got into everything from the “DOGE movement” to why Apple’s a “butt-ugly” chart, but let’s get the big one out of the way first:Long Canada

The Thesis

Jared had a big win on Argentina in The Daily Dirtnap as he “spotted Javier Milei early.” “This is one of my favorite trades to do internationally,” he said. “Anytime you have a country that is economically unfree, and it suddenly becomes free, you have explosive growth.”

So the thesis is that with the resignation of Justin Trudeau, and Pierre Poilievre the favorite to be the next Canada PM, Canada could be the next Argentina — in terms of pro-business reforms, at least.

The Environment

Similar to Argentina, Jared says the Canadian population is “completely demoralized by crappy economic policies.” “The average household in Canada is spending 70 % of their income on mortgage payments,” he said. “They had the inflation problem too, and their tax burden is really high. So, you start cutting that tax burden and magical things are going to happen.”

The Pushback

Like any contrarian trade, Jared is getting push back. He feels ehhhh pretty strongly about that:

The Trade

Pretty straightforward: the Canadian equity ETF, EWC. “If you buy the ETF, you’re buying Canadian stocks denominated in Canadian dollars,” Jared said. “So you get the currency exposure as well as the equity exposure.”

The Timing

If you like the trade but think it’s too late because Trudeau has already resigned - it’s not. “Nothing's moved yet,” Jared said. “I had the Canadian dollar up on Bloomberg when the announcement came that Trudeau resigned and it didn't move. Then over the course of like an hour it moved like 20 basis points. So it's not like you're missing the trade.”

Jared thinks the trade should start to work when (if) Pierre Poilievre takes office (we don’t know when the federal election will be yet, but it has to be by October and will likely be earlier). So there’s time to dollar cost average into it.

The “What If?”

The biggest risk to the trade Jared sees is “if Pierre doesn’t win.” “If Mark Carney runs, that slightly increases the chances that Poilievre loses,” Jared said. “That's the only thing that would make me change my mind.”

The “DOGE Movement”

JD thinks what’s happening in Canada is part of a trend. “Let’s just call it the DOGE movement,” he said. “Javier Milei started it in Argentina — he started a global movement. This is an anti-big government bureaucracy movement.”

He says it’s expanding globally, with stirrings already happening in the UK and Colombia.

The US Economy: Strong

While recessions can sometimes be a surprise, Jared says it doesn’t seem like we’re going to get a recession this year. “The economy is strong,” he said. “And if you go back to the last Fed meeting where we cut 25 bps, there was the dissent from new Cleveland Fed president Beth Hammack — she has been vindicated. We’ve had nothing but strong data since then.”

“Actually, all those rate cuts were a mistake,” he said. “The first 50 basis point cut was a mistake because the unemployment rate went up and it triggered the Sahm rule… but then

said we didn’t trigger the Sahm rule. And we cut 100 bps for no reason and stocks went up 10%, and here we are.”Here’s Gemini’s definition of the Sahm rule:

The Sahm rule is a recession indicator used by the Federal Reserve to determine when the economy is entering a recession. The rule states that when the three-month average unemployment rate increases by 0.5% or more from its 12-month low, a recession is underway. The rule is named after economist Claudia Sahm, who created it as part of a proposal to make stimulus payments routine at the beginning of recessions.

The US Markets: Eh…

Jared is short the US stock market, and says the price action is crappy. “From August to December [in 2024], there was not one trading day where the S&P closed on the lows,” he said. “It would reach a low intraday and it would always bounce. That is positive price action. In the last couple of weeks, the market is closing on the lows every single day… I think we have more downside.”

It’s “a very rich stock market,” he added. “Forward returns are going to go down. The biggest stock in the US is Apple and Apple trades at 41 times earnings and it doesn't grow.” Speaking of Apple…

Apple

“I’m short Apple out the wazoo,” Jared said. “That is one of the ugliest charts I have ever seen in my entire life…. It’s the most obvious short candidate on the board. Go look at the chart. The chart is ugly.”

More on Apple:

The Bond Sell Off: “Overdone”

Jared thinks the bond sell off “is a little overdone” at this point, with maybe 10 or 20 bps to go. “When yields go up, it makes bonds more attractive,” he said. “Bond traders a couple of decades ago had the Rule of 7s, which basically means that anytime yields get to a big round number, there’s usually resistance there because people say ‘Oh my god, I can get 5% on a bond’ and they buy bonds. Bond bear markets never go down in a straight line because you always find support — people find these yields attractive and they come in and buy them.”

💡Sentiment check: “Shorting bonds has become very consensus. Let me put it this way, the people I'm seeing on Twitter that are saying you should short bonds here? I do not respect their opinions. People are piling into this higher rates idea. And I think it's going to top out pretty soon.”

Trump, Tariffs, and the Dollar

People have been dealing with Donald Trump on a political level for a decade, but Jared says they still haven’t figured out that he’s full of…:

Basically, Jared thinks that the president-elect’s comments on stuff like making Canada the 51st state, and wanting 25% tariffs on Canada and Mexico, are really just negotiating points. “It’s a starting point for a negotiation,” he said. “[And yet] the FX markets have priced it in as if he’s talking literally.”

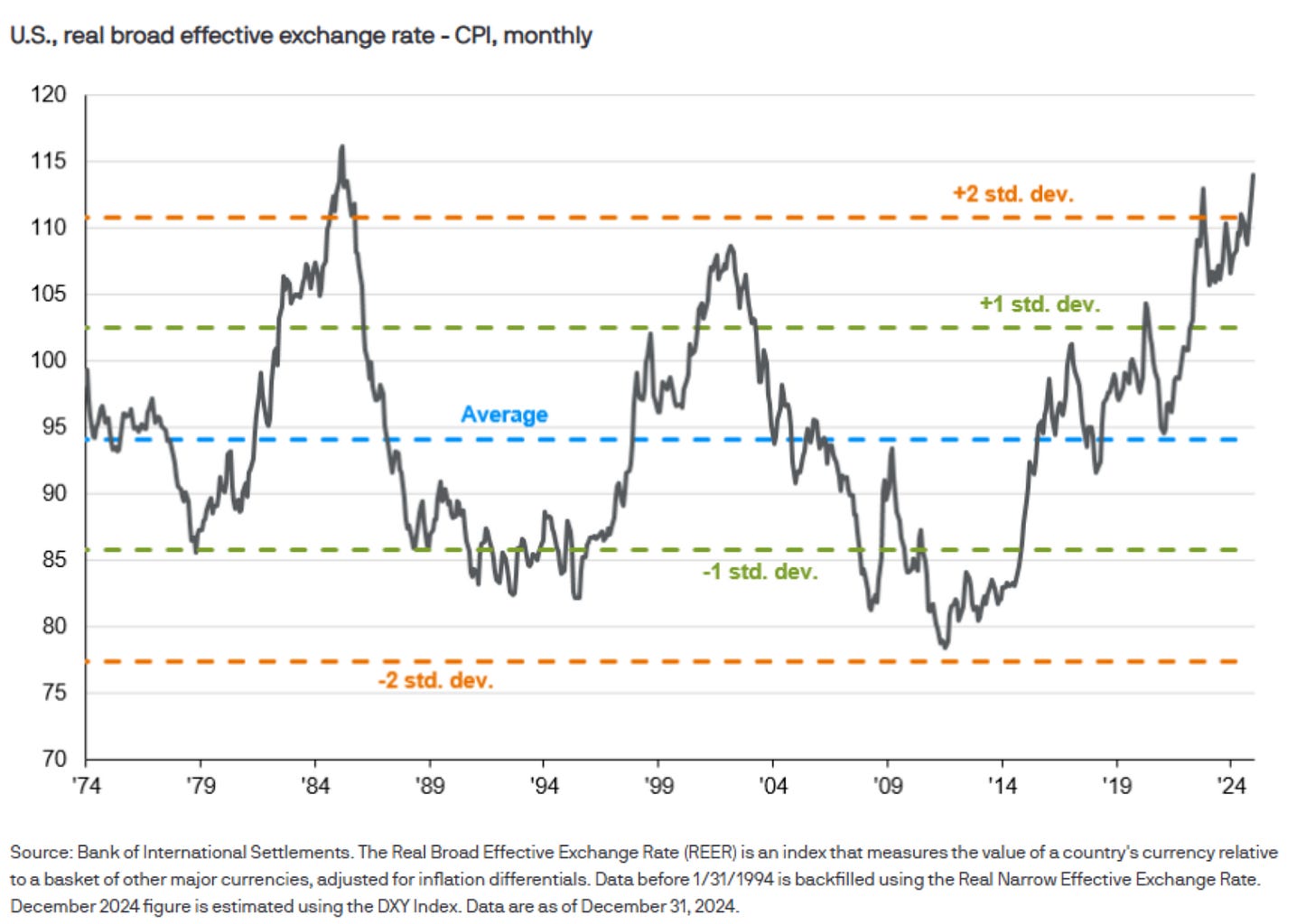

As for the dollar, JD says: “Technically, I think it's topping out, but I've been saying that for about three or four weeks and I've been wrong. So it hasn't worked, but I do think it's topping out. [Because] the dollar is pricing in 25% tariffs. If anything less than that actually comes to pass, the dollar is going to sell off significantly.”

And as he said last time on Talking Markets, he still thinks the new administration is going to start jawboning the dollar lower, as the “dollar is the most overvalued it’s been in history. I don’t think the Trump administration can tolerate the dollar at these levels.”

Does the AI Gold Rush Change the Story?

Given his stance on Apple and the US market in general, I asked Jared how the “data is the new gold” narrative fits into that — does it change how we should value some of these companies?

“That sounds like one of those bubble rationalizations like in 1999, people were looking at stocks like clicks and eyeballs,” he said. “In a bear market, none of that stuff matters. You want to buy Walmart, right? You want to buy people buying $20 rubber doormats at Walmart.”

And a final word on “Me here now” (with h/t to Peter Atwater):

To watch the full episode, right this way.

Enjoy,

Maggie

Important Disclaimer: It is crucial to remember that this article is for informational purposes only and should not be considered investment advice. Consult with a qualified financial advisor to assess your risk tolerance, investment goals, and overall financial plan.

The voice of experience: the only kind of selfishness that exceeds greed is falling net worth. Hard to disagree with that.

Excellent stuff again Maggie, thanks. Next time Jared or Dale is on, please can you ask why the Apple chart looks bad. Just looks like it is retesting a previous resistance level as support?

Thanks again.