Peter Boockvar: The Mag 7 Trade is "Tiring Itself Out"

Mag 7 may be moving into its exhaustion era, a European renaissance, and why Peter is long the "most hated market in the world."

End of the Mag 7 Era?

Peter thinks “we’re on the cusp” of Mag 7 losing dominance in the markets. “Not in terms of how great these companies are, but in terms of these 7 stocks driving so much of the market performance and dominating investor fund flows,” he said. “The whole world has piled into these Mag 7 stocks.”

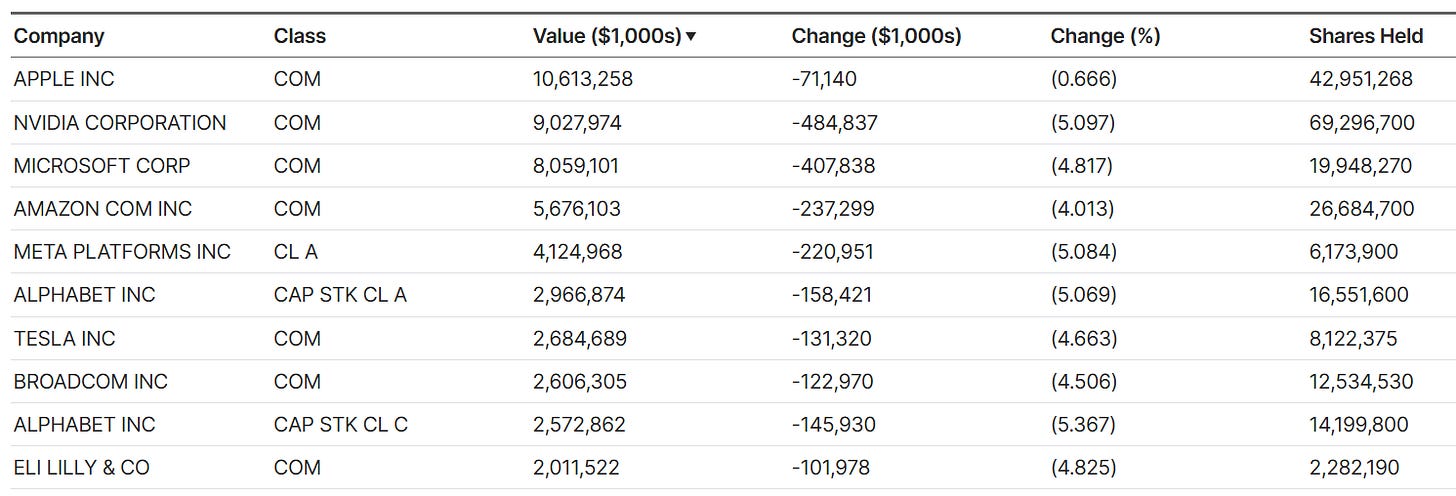

The 10th largest holder of NVIDIA is Norway’s Norges Bank, which owns more than 300 million shares

The Swiss National Bank owns 70 million shares of NVIDIA - And its top ten holdings are heavily dominated by Mag 7:

“This one decision trade owning these great companies, which has worked so amazingly and incredibly for so many years, I just think is sort of tiring itself out,” Peter said.

🪢Dale Pinkert was on roughly the same page on Feb 13. “I'd sell the Mag7,” he said on Talking Markets. “I think that what led the market up will also lead the correction.”

Tailwinds

Tesla: “Their auto business is getting more and more challenged,” Peter said. “The competition is getting more intense, more people are buying hybrids, and we know Elon is distracted by other things. And those that didn’t vote for Trump, they’re not necessarily buying any more Teslas.”

Apple: “So many bulls were reliant on the upgrade cycle…I'm not bashing Apple. We as a firm own plenty of Apple. We don't want it to go down,” Peter said. “But if all of sudden that 33 PE becomes a 20 PE, which is still kind of generous for a company that doesn't really grow, that's more than a 33 % decline in the stock. Just on a multiple rerate, not any change in earnings growth, not any change in the fundamentals of their business, just the market waking up and saying, you know, why am I paying 33 times earnings for a company that is great, but just more pedestrian in its growth rate?”

Nvidia: “I don’t necessarily think you’re going to see [the impact] just yet with Nvidia, but you just wonder if we’re a quarter or two away from eventually seeing it.”

Google: “Is Google’s search business going to be the same in a world of generative AI, when you can go to ChatGPT and get an answer?” he said. “That’s potentially a fundamental change to their biggest business.”

The AI Question

“The DeepSeek news made everyone start to rethink, what do I want to pay for all these hyperscalers?” Peter said. “Show me the revenue that you’re going to derive on all this spend… [The DeepSeek news] just showed you that this is going to be a commoditized model that a lot of people are going to use at very low cost.”

He pointed out that he is not saying they’re bad companies necessarily. And while he still thinks this iteration of AI is very exciting, “I just think that maybe from here on out, the benefits accrue to the users of it.”

💡“I think investors should potentially start focusing on how companies have integrated AI into their own businesses to make them more efficient and productive, rather than on the AI developers that are still spending such extraordinary amounts of money with very uncertain returns on that spend,” Peter said. “Meta, for example, is using generative AI as enhancements to their business that is allowing them to better tailor advertising spend to the ultimate end consumer. But enhancement is not revolutionary, it's evolutionary.”

What Are Investors to Do?

It’s a tough call for investors who have been in Mag 7 for a long time and are sitting on big gains. “But I do think that people should be maybe more sensitive to the valuations,” Peter said. “It's better to pay taxes on gains than pay no taxes because you have no gains. These stocks have done so well that maybe there's portfolio concentration in them to the exclusion of other things and maybe some people are a bit over their skis in terms of their percentage allocation in these stocks.”

💡”I think that people should just think of these things and contemplate, instead of just sitting there doing nothing and assuming that the next five to 10 years are going to be the same as the last five to 10 years. The market has a history of leadership that just transitions into other things.”

The Knock-On Effects

The US Dollar: “Foreign flows have been extraordinary into these Mag 7 stocks,” Peter said. “What happens if they find other homes outside of the US? The dollar strength that’s supposedly going to come from tariffs [would be] offset by dollar weakness as investor fund flows leave the US. And we actually then see a pullback in the dollar and thus have less of a mitigate on the tariffs.”

The US Economy: “What if the S&P falters because those Mag 7 stocks falter?” Peter said. “Then that ties into upper income spending, which is holding up the US economy.” 🪢WSJ reported yesterday that the top 10% of earners in the US account for 49.7% of all spending, a record in data going back to 1989.

Intl Markets: “Look at European markets this year. Look at the Hang Seng that's up 17 % this year and is now outperforming the S &P,” Peter said. “Investors are beginning to find other things, which I think is a good thing since most of the other parts of the market [were] left for dead, particularly internationally. So I think this is a major inflection point.”

US Markets: “Maybe the S&P starts to underperform other markets, and maybe the Russell 2000 or maybe the mid-caps start to outperform the S&P in addition to international stocks.”

🪢 That doesn’t necessarily mean buy the index. 🐿️ on the Russell back in December: “By definition, the Russell 2000 has a sort of inverse Darwinian feature in that the biggest winners in the Russell leave the Russell to go to the S&P… I love value stocks generally, which naturally brings you to small and mid cap type names, but just know what you own.”

Regime Change: “Is this going to be like 2000-1, when value dramatically outperformed as the NASDAQ was imploding? Or is it going to be like 2002 when everything fell? I don’t know,” Peter said. “Everyone just assumes that if the markets fall, they always come back. And over time, they always do. But over time, we still have periods of digestion.”

💡“I do think that investors should start widening the lens of their investing focus and not just own the big seven or even the big ten and think that that's going to continually outperform everything else,” Peter said.

Opportunities Elsewhere

“I'm not saying there aren’t plenty of opportunities out there. I'm just saying that it may not be in those seven stocks anymore.” - Peter Boockvar

Europe: “I still think European markets are attractive - not the market as a whole, but there are a lot of cheap stocks that are big multinationals that have lower multiples than some of their US brethren,” Peter said. “BP and Shell, which we own, are trading at much lower multiples than Chevron and Exxon because of where they’re domiciled… Nestle is cheap and attractively valued… Veolia Environment, one of the largest waste management businesses in Europe, is cheap.”

💡Europe still has plenty of issues, not least the bureaucracy they’ve “smothered business with.” But like Marc, Peter thinks they’re beginning to realize and respond to some of them. He says Germany’s likely next chancellor, Friedrich Merz, is “the most business-friendly politician that Germany’s had in a long time. So they’re understanding how they've created their own sclerosis and hopefully things will change.”

Asia: “I love the Singapore market. We’ve been long,” Peter said. “We’re long Vietnam… They’re slashing the size of their government, they’re slashing red tape. I’ve been bullish on the Hong Kong market for the past year plus, believing it’s cheap, and I’ve never seen a more hated market than that market. We’ve been bullish but wrong on the Macau casino stocks but remain bullish… AIA Group, one of largest life insurance companies in all of Asia, is trading in a pretty attractive multiple in Hong Kong…. I like Malaysia too. There's going to be sort of this economic zone between Singapore and Malaysia that's sounding very exciting. So Malaysia is very attractive as well.”

The US Economy Outlook

“The US economy really resting on three pillars: high-end consumer spending, anything related to AI spend, and anything related to the government,” Peter said. “So all of sudden, now we're starting to question if the government is gonna start to rein in their spending, if that budget deficit as a percentage of GDP actually starts to shrink. Well, that's a very good long-term because we need to get our fiscal situation on healthier ground. In the short term, that's going to be a negative for the economy. And if you're living in the DC metro area, I would have to believe you're maybe not going out for dinner as much if you have a government job or you're in a home that has just been marked down… And then you have a lower to middle income consumer. That's obviously on much shakier ground right now, too.”

💡“We know services has been the strength that's carried this economy because manufacturing has been in a recession for more than two years,” he said. “The existing home sale market is seeing the slowest pace of transactions in 30 years. Capital spending, ex-AI, has basically been flatlining. Global trade has been muted. it's a very strange sort of economic foundation that we're sitting in right now.”

Peter’s Energy Outlook

“We’re bullish on oil and has stocks,” Peter said. “I think oil at $70 is cheap. I think natural gas, even though it’s rallied, under $4 is cheap. So we’re bullish and long energy stocks, oil and gas stocks. We think the fundamentals are good.”

But what about the idea that the Trump administration will find a way to push energy prices down?

“If I’m the CEO of an oil company, I’m only going to drill if the price is right,” Peter said. “I answer to shareholders, not the president. Trump's president just for four years and then he's gone. So I'm not going to destroy the value of my company, my profits, and my stock because he wants lower oil prices.”

To watch the full episode, right this way.

Enjoy,

Maggie

Important Disclaimer: It is crucial to remember that this article is for informational purposes only and should not be considered investment advice. Consult with a qualified financial advisor to assess your risk tolerance, investment goals, and determine if an allocation to oil aligns with your overall financial plan.