Acorns from the 🐿️ on Talking Markets

Blind Squirrel Macro's Rupert Mitchell on the Russell's inverse Darwinism, the new "equity culture" in China, and opportunities ex-US.

There are plenty of opportunities outside the US for investors willing to put in the work and size accordingly,

(A.K.A. Rupert Mitchell) said on Talking Markets yesterday. I enjoyed this episode a ton as we went all over the map (literally) and into ideas not discussed much elsewhere. Or as Rupert put it, he is “the rodent equivalent of a Swiss Army penknife… I can be anywhere in any asset class.” Let’s dig in to those acorns…Beware the Santa Rally and “Chase” Dynamics

“There’s a lot of money chasing not enough stocks at the moment,” Rupert said of the year-end rally. “It is a self-fulfilling infinity machine to a certain extent, but it does feel like the air is pretty thin up here.” For more from the 🐿️ on the Santa rally, his piece here is a fantastic read.

Like Warren Pies, Rupert sees end-of-year chase dynamics at play, where money managers have to go after returns. “They have the tyranny of annual benchmarking versus the index,” he said. “And if you’re not overweight the biggest winners in that index, you’re going to have a very tough conversation with your bosses and your clients at year end.”

Individual investors don’t have the same problem. “We do have the option to take a pause,” he said. “Cash is the most valuable option at times like this. This feels like a market that could put in a nasty punchy drawdown at any time.”

And Take 2025 Outlooks with a Dose of Salt

Wall Street strategists pretty much have to be “bullish most of the time,” Rupert said. “[They] can be tactically bearish from time to time, but the whole complex of big retirement is based around ‘markets go up and to the right.’ The capital markets machine needs positive momentum, [so] you need to take the strategist year ahead target index levels with a healthy dose of salt.”

The Inverse Darwinism of the Russell 2000

Right after the election, there was a lot of talk about the great rotation into small and mid caps that was going to happen. Rupert thinks the post-election gap has pretty much been filled and is wary of people reaching for small and mid caps as an index - rather, he says, it’s a stock-picking world.

“By definition, the Russell 2000 has a sort of inverse Darwinian feature in that the biggest winners in the Russell leave the Russell to go to the S&P,” he said. And right now, “the percentage of the Russell that doesn’t make profits is enormously high by historical standards.” (The 🐿️ did a deep dive on this here.)

💡”I love value stocks generally, which naturally brings you to small and mid cap type names, but just know what you own,” Rupert says. “Ultimately, it should be a stock picking world when you're in the world of small and mid caps. You've got to do the work on that. Or find a smart mutual fund manager that's doing that work for you.”

The US: Thin Air

Most investors have had a pretty great year, “unless you’ve been fighting it tooth and nail,” Rupert says. “So it’s tough not to be fully engaged with US equities, but there will come a time where we have some kind of regime shift, where it makes more sense to be more diversely spread.”

He also pointed out that while Nvidia has been “the story of the year” and “will continue to make an awful lot of money,” it’s still at risk of derating.

Side Note on Nvidia and its role in the S&P:

Source: Jeffrey Kleintop

🤐

Additionally, Rupert says the policies of the incoming administration in the US “all lean on a weaker US dollar.” (Jared and Weston think so too). “And a weaker US dollar is really good for short duration emerging assets.”

China: Stocks “Working Remarkably Well This Year”

“If you look at the Chinese bond markets, we're seeing record low yields in the Chinese 10 year right now,” Rupert said. “But you've had a green light from the authorities as a Chinese investor to buy equities… They want to create an equity culture.”

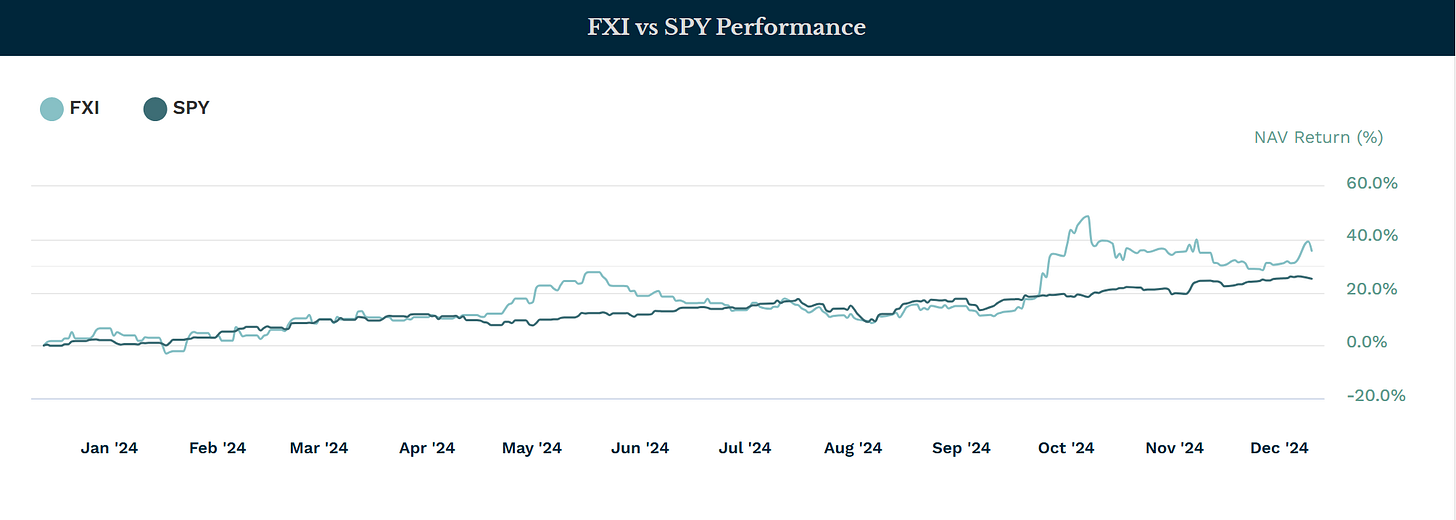

And look no further than the FXI (the iShares Large Cap China ETF) for proof that it’s working. “As of last Friday, the FXI was neck and neck with the S&P 500 on a total return basis,” Rupert said. “Chinese stocks have been working remarkably well this year.”

Source: ETF.com

Rupert thinks the China opportunity is “a multi-year opportunity with interesting entry levels here and now.”

💡Of course, caution is needed. “I actually think the way of staying in the trade in Asia is to target sort of more low beta type exposures,” Rupert says. “Stay away from the crazy volatility and it'll allow you to stay in the trade and compound away.”

Africa: Opportunity in the Long Run

The opportunity in Africa in the long run is “phenomenal,” Rupert says. “Obviously, it’s deep value, [but] it’s where all the population growth is coming from over the next several decades, '[and] you’ve got a huge percentage of global natural resources on that continent.”

There’s the VanEck Africa ETF (AFK), which Rupert says is “sensibly structured.” “There's a sort of China derivative play here because you can hitch a free ride on all of the One Belt, One Road investment that China's been making in infrastructure and other aspects of the African economy,” he said. “And I think that's a really interesting way to play it.”

Further out the risk curve, there are also “some interesting offshore listed businesses that have direct interests in telecoms and e-commerce in Africa” which Rupert finds interesting too, and then at the very extreme end of the risk spectrum there are African equities and credit.

💡Overall, he says, “a broad-based African ETF is something you can probably camp out in in a small way for the longer term,” he says. Emphasis on small way. “It’s something you can only protect yourself with, with sizing.”

Latin America: Worth a “Healthy Slug” of Exposure?

Rupert says that the iShares Emerging Markets Dividend ETF (DVYE) is worth looking at “if you like the idea of short duration, high yield, low valuation.”

DVYE gives you access to 100 dividend-paying emerging market stocks, including stocks from China, India, quite a lot of Brazil, some large caps from Chile and Colombia, and some interesting stocks from Eastern Europe.

(More from the 🐿️ on DVYE here: Clipping Emerging Divvies.)

💡The average underlying earnings for those constituents are “still growing at 5% on a forward 2-year CAGR basis,” and they’re “paying a punchy yield of around 8.5%,” with the free cash flow yield on the underlying companies in high single digits. “In aggregate, they've got cash to the tune of 34 % of market cap,” Rupert said. “So you've got plenty of margin of error.”

To watch the full episode, right this way.

Enjoy,

Maggie

Important Disclaimer: It is crucial to remember that this article is for informational purposes only and should not be considered investment advice. Consult with a qualified financial advisor to assess your risk tolerance, investment goals, and overall financial plan.

Maggie, this was one of my favorite episodes as the Blind Squirrel is always extremely insightful and thought provoking. Well done to the both of you! Thanks.

Great summary write up for those don’t have time to listen 🎧 Thanks 🙏🏽