Marc Chandler: "This Is the Most Acute Crisis for the Europe/US Alliance Since the Suez Crisis"

Shifting geopolitical tectonic plates, why Europe grows in a crisis, opportunities that AREN'T the S&P, and why the dollar is likely to go up before it comes down...

Yesterday (February 19) on Talking Markets I was joined by Marc Chandler, Chief Market Strategist at Bannockburn Global Forex and author of Marc to Market.

I've known Marc a long time, and I love chatting with him because he is very experienced, has a global view, and is pretty much a Swiss army knife in that he is knowledgeable about all the asset classes you can think of. He didn’t disappoint, so let’s dig in…

Markets Hate Uncertainty

We’re living in a time of incredibly fast-paced change, on top of what Marc describes as a “series of shocks,” which include COVID, Russia’s invasion of Ukraine, de-risking from China…

“But I think the biggest risk for investors right now is coming out of the US,” Marc said. “It’s the tariffs, it’s the pulling out of things like USAID, it’s leaving the World Health Organization.”

As we know, markets hate uncertainty.

“There’s this ancient Greek* who said that if you give him a lever and someplace solid to put his feet he can move the world,” Marc said. “I think the problem we have is there's no place to put our feet anymore that's solid. Things that we got used to, like globalization, encouraging Europe to distance themselves from China, friend-shoring… This was supposed to be the new order. And now we're told that only on-shoring really counts.”

*This ancient Greek is Archimedes

New Spheres of Influence Emerging

As part of this change, “the US is moving away from” the kind of icons of free trade that dominated the 20th century - the IMF, the General Agreement on Trade and Tariffs, World Bank - stuff like that.

“When I listen to President Trump, he thinks our biggest rivals, the people that have hurt us the most are not our enemies like Russia or China, but our allies,” Marc said. “And so a lot of Trump's policies seem to be aimed more at them than Russia or China. Greenland, Panama Canal, Canada becoming a 51st state or whatever that really means - I think that this is partly happening as the US is grabbing its sphere of influence.

🪢This aligns with

’s take from Talking Markets in January: “Some of the things that Trump is talking about right now, they're not out of the general frame of US foreign policy,” Jacob said. “That was classic US foreign policy imperialism in the early 1900s. And that's what it looks like to me - ‘Greenland has resources. I would like to buy that. Panama has a canal that we want to use. I would like that. And I will use my economic power to get it.’”This realignment has consequences:

“I think it means we’re not going to spend US money or American lives stopping another country from grabbing their sphere of influence,” Marc said. “Hence, having Ukraine give up a lot of its territory.”

And of course, there are consequences for wider Europe, too (more on that later).

A Look at Forex

First things first, a note on the sheer vastness of the forex market:

“The foreign exchange market has an average daily turnover of $7.5 trillion,” Marc said. “To put it into context, world trade in a year is only about $35 trillion… The world’s GDP is about $100 trillion, and so we do that in 3 weeks.”

And even if you’re not trading currencies directly, it’s hugely important for investors, too. “Your currency component could be two-thirds of your return,” Marc said. “And if you have a portfolio of international stocks, like many of us have in our 401Ks, our retirement plans, the currency could be about a third of the return of an international equity portfolio. So getting the currency right is half the battle or a third of the battle or so.”

What’s Going on With the Dollar?

In Marc’s opinion, the dollar is very overvalued. “I think it’s almost more overvalued than at any time going back to sometime a little bit after the Plaza Agreement in 1985.”

That said, Marc thinks “we’re still probably in for a further bout of dollar strength.”

He thinks it all comes down to Fed policy, and here’s how he sees it playing out:

He doesn’t think the Fed will cut rates in the first half of 2025, while many other countries (the Eurozone, UK, Canada, Australia, New Zealand, Norway) are likely to cut rates in before July. This period is when Marc sees more dollar strength - which will also be helped by “the political shifting tectonic plates.”

When the Fed starts cutting rates again, which Marc sees happening in the second half of the year, “the dollar will fall,” he said.

Won’t it be propped up by tariffs?

Eh, Marc thinks maybe not. “Tariffs are a tax on consumption, and [so] I think that the US economy is going to be slowing down, partly because of the tariffs, partly because of the layoffs in Washington, and [partly] because of how GDP has been helped by immigration in the US.”

A lot will depend on how tariffs are rolled out. “If there's this water torture where it's drip, drip, drip, we don't get a chance to have a one-off,” he said. “If it's a one-off, I think the Fed could live with that, especially if it is coupled with demand destruction.”

The S&P 500

Even though the S&P 500 hit another record high yesterday (February 19), Marc says that “in some ways US stocks are sort of underperforming.”

Stocks that aren’t part of the Magnificent 7 have really underperformed,” he said. “When you really look at what’s going on in the rest of the US stock market, something like 40% of the Russell 2000 are losing money.”

He pointed out that the S&P is up 3-4% this year, while China is up over 16%. “I think there was a big shock to a lot of mainstream worldview when DeepSeek was unveiled by China,” Marc said. “I think the U.S. maybe a bit naively thought we can stop them from developing their high-end technology, or that some people even think that communist countries can't have that creativity. In my work, I find that China is graduating more engineers in a year than the US has. And so I think that the competition has changed.”

🪢Hat-tip to the 🐿️, who was on top of the China equities story.

💡“I've been suggesting that our clients and individuals shift money, diversify away from the US,” Marc said.

But to where…?

Diversify, Diversify, Diversify

“All of us in the US are really exposed to US stocks through our jobs, through our equity, through our stock that we might own, jobs, our environment,” Marc said. “We tend to be overweighted to the biggest and one of the best performing markets in years. But I think that there's opportunities elsewhere.”

💡“If I'm right about these spheres of influence emerging, then there's going to be interesting opportunities as these new spheres develop,” Marc said. “And if I'm right about these spheres of influence, it also means somehow Europe is going to have to develop their own munitions arms industry.”

Not investment advice, but here are some of the areas Marc mentioned:

“The DAX - it’s not just this year where it’s outperforming the US, in the last two years it’s up about 30%, and of course, it doesn’t have the tech giants like our Magnificent 7.”

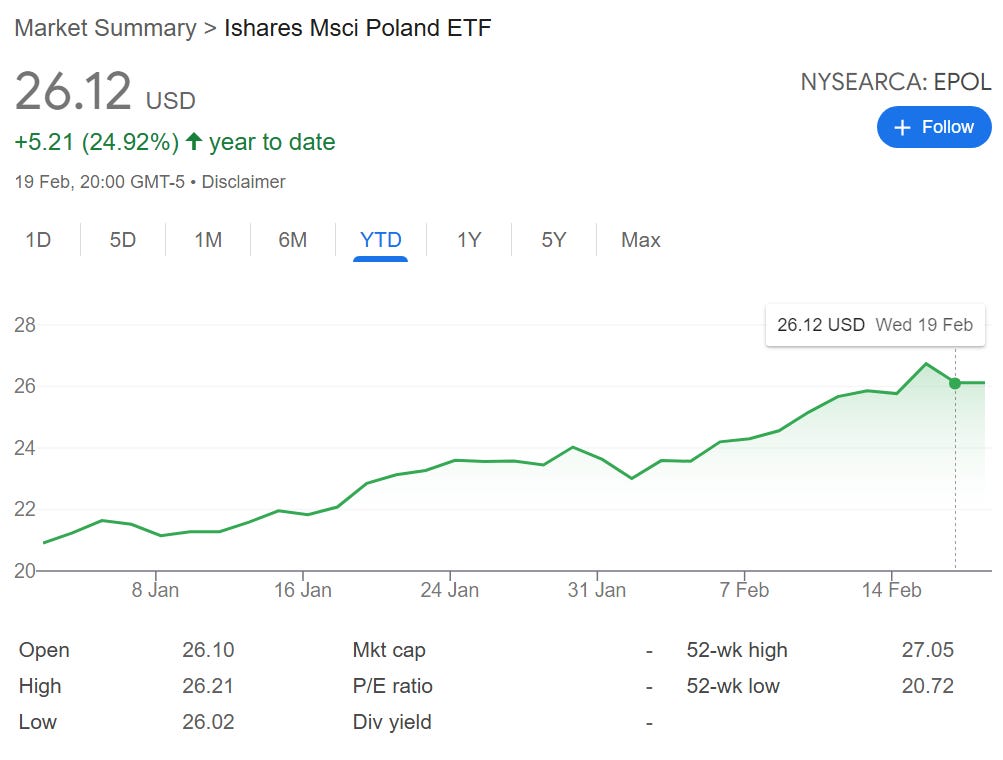

“Poland is really, I think, an underappreciated, credible story since the end of communism. Poland is a large country, has a diversified economy, and its stock market is doing quite well. And I think that going forward, Poland's construction companies will probably be a big help to rebuilding Ukraine.”

🪢Sam Rines flagged the “Poland rebuilding Ukraine” narrative for us too back in November.

🪢

flagged in the live chat that the Poland ETF, EPOL has had the highest return this year of any other country ETF, up 25% so far:Europe: In Crisis But That’s When It Grows

If the US cuts a deal with Russia over Ukraine, and the US makes a trade deal with China, “Europe is going to get marginalized,” Marc said. “And I think that its leaders are going to recognize this and increase coordination efforts.”

“In some ways it's a bit like Benjamin Franklin told us as 13 small colonies on the east coast fighting the biggest empire at the time. He said you either hang together or you hang separately.”

The upcoming German election matters, but Marc thinks that it is likely to result in more of the same - as the far-right AFD party has dipped in the polls since Elon Musk and JD Vance endorsed it (though, to be clear, it’s still on track for its best performance ever).

“There's a saying in Europe that Europe grows in crisis,” Marc said. “So I think that it'll come out of this.” Some of what he sees happening:

Europe will have to issue joint bonds (like they did during the pandemic and the GFC)

Those bonds will probably be used for defense spending as they have now been given the clear message that they can’t depend on the US anymore.

Europe is going to build their own weapons. “It might take them a few years to like get it going, but I think that's the direction things are going,” Marc said.

“This is the most acute crisis in Europe and the US alliance I think since the Suez Crisis,” Marc said. “I think Europe grows in this kind of crisis, and I would look for a greater integration.”

Asia

While Marc flagged Chinese innovation and the stock market earlier, that doesn’t mean he’s saying go all on on China. They still have domestic issues, and “it’s tough to invest in China because you don’t know as Americans what you’re really buying when you buy a Chinese company that’s listed in the US,” he said. “Are you really buying a share of that company, or is it just a paper claim?”

Marc also sees China potentially building plants and production within the US and Europe, similarly to how Japan now builds cars within the US.

💡Because of that uncertainty, Marc is looking at “other pockets that are benefiting from the offshoring away from China, like Vietnam, Malaysia, and other smaller East Asian countries.”

🪢Jacob was going the same direction in terms of “looking for places benefiting from insert-type-of-shoring-here,” mentioning Mexico, Indonesia, and India.

To watch the full episode, right this way.

Enjoy,

Maggie

Important Disclaimer: It is crucial to remember that this article is for informational purposes only and should not be considered investment advice. Consult with a qualified financial advisor to assess your risk tolerance, investment goals, and determine if an allocation to oil aligns with your overall financial plan.