Brent Donnelly on the Fed's White Whale

On Talking Markets: sticky inflation, the search for neutrality, and a potential sharp correction in Q1...

Inflation isn’t going anywhere, the Fed’s desperately searching for neutrality, and we could be in for a sharp correction in Q1, Spectra Markets’

said on Talking Markets on Friday.Sticky Inflation

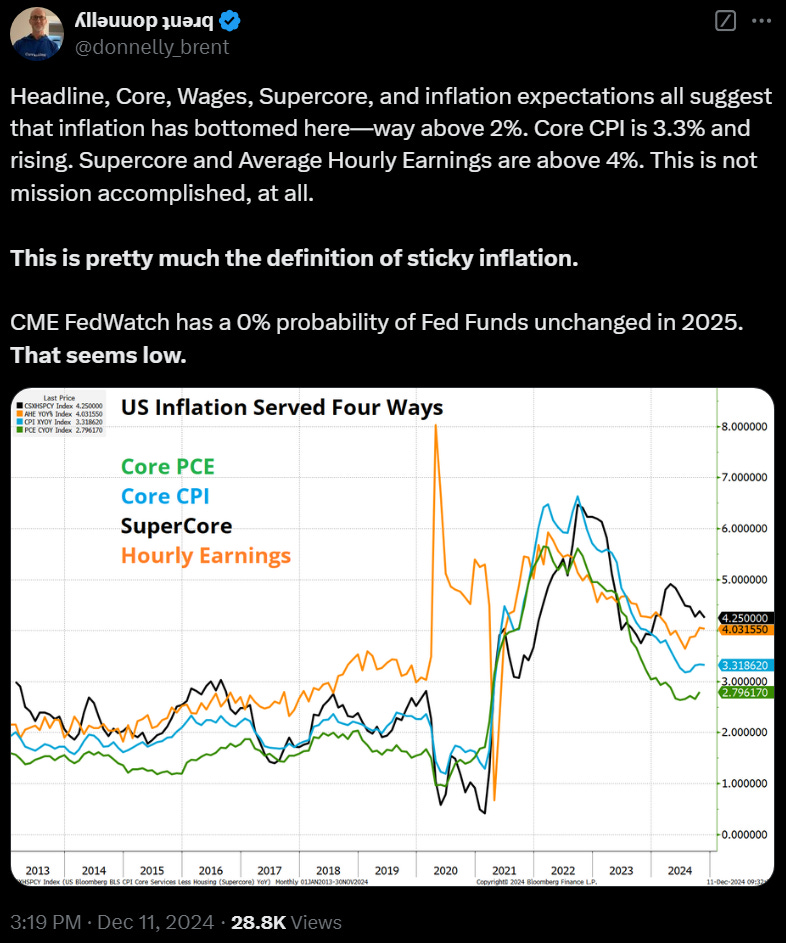

The landscape is… sticky. “Inflation isn’t going down anymore - it hasn’t been going down for 6 months,” Brent said. “If you look at core services and wages, and even core PC and core PCI, none of them are even close to target and none of them are going down anymore.”

Source: Brent Donnelly

Brent points out that it’s the rate of change in inflation that matters to the Fed at this point. “If it was running steady and flat at 2.7%, I think they'd be perfectly happy with that. The problem is if it's rising,” he said.

💡Ahead of the Fed’s meeting next week, Brent said: “Maybe this is the last cut for a while. I think I’m starting to get interested in bets on no change for 2025.”

The Fed’s White Whale: Neutrality

The theory is that if interest rates are at neutral, they’re neither restrictive nor accommodative, which is (again, in theory) neutral for financial conditions and neutral for the economy.

The problem, Brent says: “They don’t know where [neutral] is.”

Brent says they hike for a while, then try and glide back down to neutral. “But the problem is, the longer that rates stay up and things don't break, then the higher you have to estimate that neutral is. So the Fed has been raising their estimate of neutral, but it's very slow. Basically, it ends up being very pro-cyclical and very unobservable. It's kind of this finger in the air thing.”

The Fed + Policy

Also on the Fed’s decision-making plate are the potential policy changes coming out of the new administration, though it’s kind of “wait and see.”

Tariffs are “too difficult to game plan for the Fed because it’s a one-time inflation shock that could be bad for supply chains, trade, and the economy,” Brent said.

As for the “one trillion dollars of cuts” being discussed, Brent doesn’t think they’re serious, and also thinks that tax cuts will be more marginal than last time.

So, overall Brent thinks the Fed doesn’t need to worry about Trump policy too much, “except for if somehow spending gets unleashed, then that would definitely be a factor… The Fed would have to react to [that] because the kindling is already there for inflation to go back to 4.5%.”

Q1, 2025: A Nasty Correction?

“I do believe Q1 is gonna be tough for stocks, because you’re priced for perfection,” Brent said. “And I don’t really think you have the Fed at your back necessarily.”

Brent sees a potential big correction in Q1:

Like

’s Peter Boockvar, Brent is concerned about the fact that the US Conference Board Consumer Confidence Index is max bullish, at the highest levels it’s been since it began in 1987.Brent says people don’t like selling winners towards the end of the year because of tax implications, but there could be a reappraisal in January.

Then add in potential tariffs, etc.

And leverage could make a correction nasty. Brent says while isn’t much leverage in the economy, he thinks “there’s lots of leverage in the stock market.”

A prime example is MSTX, a leveraged ETF which invests in MicroStrategy, which is of course a play on Bitcoin.

The amount of leverage in markets “means that I think the risk reward of stocks in the first 12 weeks or even first 8 weeks of the year is going to be super bad,” Brent said.

“Binary Disequilibrium” in the Dollar

Basically - Tariffs happen, dollar goes up; tariffs don’t happen, dollar goes down.

“Say Trump just said [he was] just kidding about the tariffs, the dollar will drop 5 % in a really short time,” Brent said. “And if he does a 60 % tariff on China, the dollar will go up 5%. So we're in this weird binary disequilibrium in the dollar, either it's got to be 4 % higher or 4 % lower.”

The only alternative would be “some kind of thread-the-needle thing where he says we’re going to do a small tariff now and increase it by 1% every 3 months or something,” Brent says, but we’ll have to wait for January 20 or the weeks after to get more information on the dollar.

Japan: Upside in the Yen?

We’ve heard Weston talk about the flight of Japanese capital into US stocks - Brent sees the opposite happening on the bond side.

“Japan has the biggest pool of savings in the world and a lot of it's run by the Government Pension Investment Fund (GPIF) and the big pension funds in Japan,” he said. “And they've been starting to talk about moving money out of foreign bonds into Japanese government bonds (JGBs)” as European yields decline.

“I think we are at the front edge of some repatriation where the big money in Japan will start buying JGBs and getting out of foreign bonds,” he said. “And so that will support the yen. Also, there's kind of now a limit because weaker yen is inflationary. It's politically unpalatable.”

💡”There's a lot of upside,” says Brent, “but since I'm bullish dollar, I want to be doing being long yen and and trading it against other currencies that I don't like, like Canada. So like short CAD yen.”

Something to Think About

One of the things Brent teaches in Spectra School is that investors should try and think in terms of probabilities and not in a deterministic way.

“I think the dollar's going up, but I'll always have a tree of the possibilities, and then try to extract some expected value from that, especially if you use options,” he said. “Generally, I think people tend to be too deterministic. The reason that's bad is that it gets you into a mode of thinking with confirmation bias where you're so confident in your view that you listen to all the people that agree with you, but then when people disagree, you think that person's an idiot.”

To watch the full episode, right this way.

Enjoy,

Maggie

Important Disclaimer: It is crucial to remember that this article is for informational purposes only and should not be considered investment advice. Consult with a qualified financial advisor to assess your risk tolerance, investment goals, and overall financial plan.

Brent is not for rookies, he's not for PHDs either!! lolol... He is probably the best informed and capable macro analyst covering FX I know of. But he's also very human and he TRADES which means, just like all us, he has his winners and losers. But he's very honest about keeping a bright line between analysis and P N L ... so you get to consume his thinking without the obligatory nitpicking trade recs. Very worth watching and reading his writing.