Peter Boockvar: "Too Much Complacency on Tariffs"

A two-lane economy, enormously exuberant markets, and the threat of tariffs as a revenue generator rather than a negotiating tool... oh my.

Sentiment is massively stretched and there is way too much complacency on tariffs, Peter Boockvar, author of

and CIO of Bleakley Financial Group, told me on Talking Markets yesterday.The US Economy is a Two-Lane Highway

While the headline GDP number is still good at 2.5-3%, Peter sees a lot of cross currents lurking beneath. He’s been describing it as a two-lane highway:

In the Fast Lane: Higher income spending on travel and leisure, higher home prices, a decent labor market, beneficiaries of AI spend, government spending on healthcare, the CHIPS Act, the Inflation Reduction Act, and infrastructure.

In the Slow Lane: Low-to-middle income spending, a circumspect consumer, a recession in manufacturing, muted global trade, the pace of existing home sales near 30-year lows, and muted capital spending outside of AI.

“So all in, the headline numbers seem good, but you really gotta look under underneath and realize that it's very mixed,” Peter said. It’s not just the US either - Peter pointed out that in Europe, Germany, France, and Italy are basically contracting, while Spain is a bright spot. And in Asia, China has decelerating growth while India is growing 7%.

Complacency and Euphoria in the Markets

Peter says things have gotten very frothy and complacent, and shared a whole bunch of stats hammering home the point:

The Conference Board Consumer Confidence Index: The highest percentage ever said in November they think the stock market is going to be higher in the coming year. It hit an all time high in October and then crushed that in November - and this question has been asked since 1987.

The Weekly Citi Panic Euphoria Index: It's “literally off the charts euphoric,” Peter says. As of November 22, it was at 0.59 - well above the 0.41 euphoria threshold. “According to their work, when it gets above that 0.41, there is an 80 % chance that a year from now, the stock market will be lower than it is today,” Peter says.

The Investors Intelligence Number: “From my many years of watching this, whenever the bull-bear spread gets above 40, I consider that extreme,” Peter says. “And right now, it's about 44, with bulls around 61-ish and bears around 17-ish. So that's very stretched.”

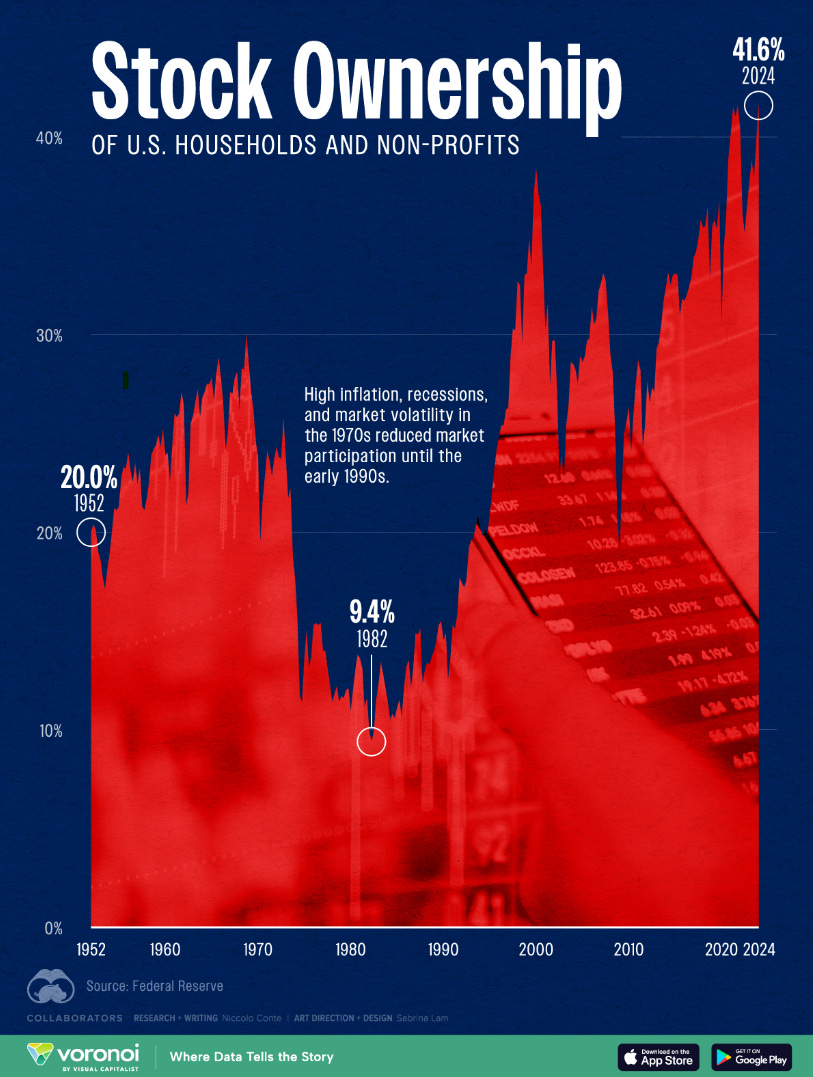

Stock Market Participation: And then there is the percentage of household assets in the stock market, which is at record highs:

Source: Visual Capitalist

💡“The sentiment and the exuberance is very much on one side. Now, it can stay that way through the year end, but if you have more of a short-term time horizon on markets, you should have one foot out the door,” Peter says. “If you're a longer-term investor, you don't necessarily have to focus as much on short-term things, but everyone should be focused on the investing surroundings they're in right now.”

What’s the Fed to Do?

This two-lane highway economy and exuberant markets make things pretty tough for the Fed. On one hand, the most recent Fed Beige Book showed 10 out of 12 districts reporting no growth. On the other hand, other parts of the economy are solid and “markets are partying on,” Peter said.

If the markets are right, then “the Fed should not be cutting interest rates, and if anything, they should be hiking again,” Peter said. But if markets are wrong, then “well, we have a bubble on our hands in equity and credit markets.”

Peter also questions whether what markets are saying can be trusted. “The stock market [used to be] a discounting mechanism,” he said. “It anticipated what it thought was going to happen in the coming six months. But to me, ever since the Fed entrenched themselves so much in markets with easy money, I thought that the stock market was much less of a discounting mechanism and really just traded on the flow of credit and the level of interest rates.”

🪢Worth re-reading Mike Howell’s take on the Fed’s “not QE-QE” here.

Nonchalance Around Tariffs?

The consensus seems to be that tariffs will be used as a threat and a negotiating tool, Peter says.

But… in order for the Trump administration to extend expiring tax cuts next year, they need “$4 trillion over a 10-year timeframe of pay-fors.”

So does that mean the administration might use tariffs to raise revenues for that bill?

“If we're just slapping tariffs on because we're trying to raise money, that's not a good thing,” Peter says. “The market is not priced for that scenario at all. I'm beginning to become more worried that in search of these pay-fors, they're going to really go at it with these tariffs just for the sake of raising money rather than having any strategic value to it.”

Bright Spots

Peter’s not saying it’s time to stock up on canned peaches and run for the hills - just that investors really need to think about the environment we’re in right now. He does see some bright spots, too:

In the US: He says that since July the market has broadened out from the Magnificent 7 stocks. “I do think there are opportunities for those that do their fundamental homework to differentiate between the winners and losers in this current economic state,” he says.

In Europe: There are also opportunities if you look for them - while there is no growth in Germany and France for example, Greece, Italy, and Spain are being helped by tourism.

💡“If you're going to invest in Europe, make sure you're investing in companies that are big multinationals,” he said.

In Asia: “I’m much more bullish on Asia, much more bullish on the growing middle class story. Even in China, and certainly in India, and Indonesia, and Thailand, and Malaysia, and the Philippines, and Vietnam, there is a very exciting story when looking out over a longer term time frame there,” Peter says.

To watch the full episode, right this way.

Enjoy,

Maggie

Important Disclaimer: It is crucial to remember that this article is for informational purposes only and should not be considered investment advice. Consult with a qualified financial advisor to assess your risk tolerance, investment goals, and overall financial plan.