Trading the Election Aftermath, with Tony Greer

Money managers buying like drunken sailors, the dollar running over everything, and the return of Bitcoin laser eyes (maybe)...

“Nothing says capitalism is in and Marxism is out like five-sigma rallies in Goldman Sachs, JP Morgan Chase, and American Express,” - Tony Greer, Nov 6.

The Morning Navigator’s

was so energized by the market action yesterday that he was, direct quote, “literally trying to keep one hand in my pocket so I don't talk like an Italian.”It was an extraordinary day that totally (though we’ll see whether temporarily) destroyed the “sell the fact” thesis - that the market had already priced in a Trump win. Instead, multiple sectors posted big wins, and continued today after the Fed cut another 25bps.

Here’s what Tony and I got into on Talking Markets…

Election Aftermath Surprise

“The most surprising thing is the unbelievable strength in the markets in response to the Donald Trump election,” Tony said. “That may still happen, but the odds of it are waning given the way the market performed today.” Tony said the pretty much everyone had been expecting a “sell the fact” market event. Instead, we saw huge rallies in banks, homebuilders, the dollar, industrials, airlines, software, and more. “With that kind of powerhouse lineup coming out of a purely emotionally driven election result, it's hard to even fathom fading this move right now,” he said.

Careful Now

Investors need to really dial in their risk management and not get carried away in markets like these. “It’s hard to make money in the highs of a market, even when you’re bullish,” Tony said. “From a tactical perspective, be prepared to trade more, not less, and be prepared to bail out of your position. Make sure your 10% loss doesn’t become a 30% loss.” Additionally, Tony cautioned against chasing runaway markets and instead wait for potential pullbacks and dips.

Drunken Sailors

It looked like money managers “started their engines and started chasing performance” yesterday morning, Tony said. “[They were] buying the S&P like drunken sailors into new all-time highs, and that’s not usually a one-day event.”

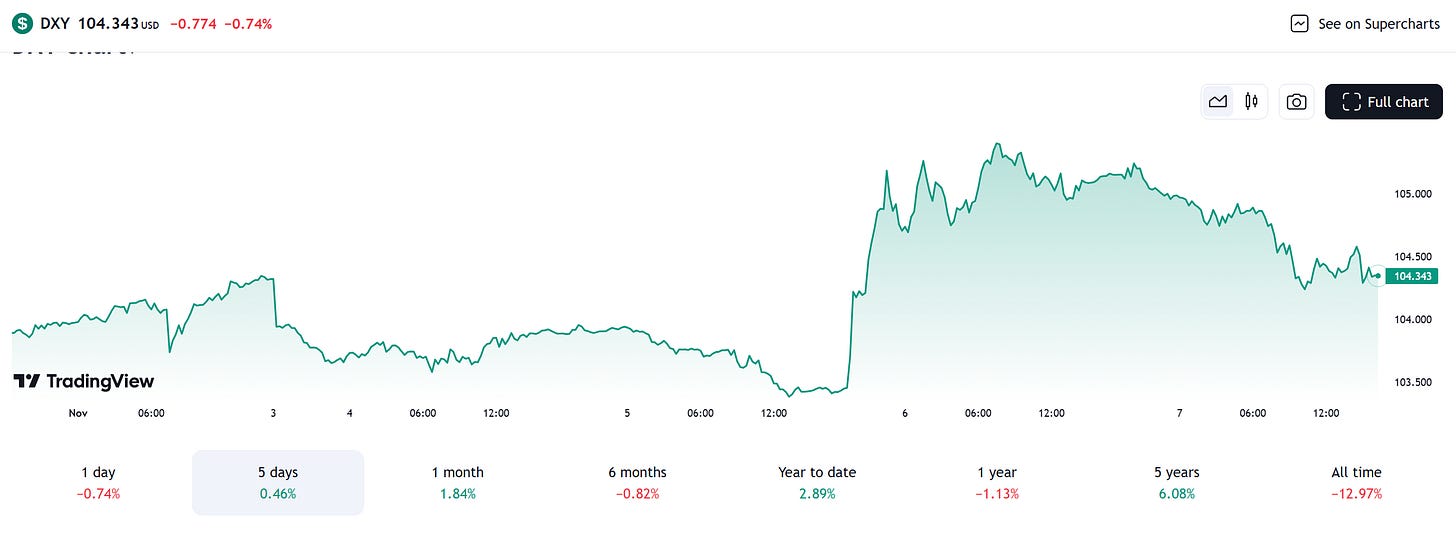

The Dollar Steamroller

“The dollar came out like it had a cape and a DJT 47 on its chest [yesterday], and it freaking ran over everything,” Tony said. “Everything in its path got decimated.”

The dollar pulled back slightly today - but not much:

Gold Takes a Breather

Gold pulled back yesterday, which Tony attributes to dollar strength. He said gold was pretty much due a breather anyway, but expects it to “comfortably” stay in a bull trend and just move back into moving averages (It’s already clawed back some of yesterday’s losses today.)

The Return of Bitcoin Laser Eyes?(!)

“I'm about to put laser eyes in my avatar,” Tony said. “I wrecked the laser eyes the first time and now I want a pair of my own. The chart could not look better.” Tony said BTC is obviously a levered bet on risk assets, and that given that the “slow moving cars” in the risk asset race (tradfi asset classes) were making huge moves yesterday, “I'm going to say that this thing is breaking out like a house on fire and has the potential to go from 75k to 80k to 90k.” Plus, he sees relentlessly steady corporate inflows into BTC.

Bond Market Worry

Bond yields moved higher on the election news, but Tony pointed out that the entire yield curve shifted in unison - avoiding the kind of dramatic steepening that typically signals economic stress or policy concerns. However, he said the Fed is “at risk of a policy error because we’re cutting rates with the S&P at all-time highs, and it seems like it might be wildly inflationary. But then you’ve got the counterweight of Trump in office now, which is more than likely going to bring energy prices right down, so that will be disinflationary.”

To watch the full episode, right this way.

Enjoy,

Maggie

Important Disclaimer: It is crucial to remember that this article is for informational purposes only and should not be considered investment advice. Consult with a qualified financial advisor to assess your risk tolerance, investment goals, and determine if an allocation to oil aligns with your overall financial plan.

Everyone’s favorite duo 🔥