Jeff Snider on an "Unrecognizable" Recession

If it doesn't look like a recession, quack like a recession, or walk like a recession, can it still be a recession?

Eurodollar University’s Jeff Snider joined me on Talking Markets yesterday (February 21) for an outlandishly enjoyable conversation on the broken monetary system, why there isn’t really any historical precedent to the current economic state of the world, and why governments are being ousted around the globe…

Stocks & Bonds See Different Things

Stocks continue to march higher, while bond yields seem to be drifting lower - I’ve been puzzling over that as they normally have an inverse relationship, so I asked Jeff for his take.

Turns out, stocks and bonds are looking at different things.

Stocks “are going to up unless and until the market perceives a recession,” he said. “Essentially, the stock market is looking for what it perceives as recession risk - negative GDP, some negative payrolls, [etc]… Stocks are like, ‘hey, we don’t see recession, buy buy buy.’”

But the bond market is saying “there are other types of recession, not just the traditional V-shaped pattern,” Jeff said. “Bonds are saying, ‘well, there are other types of downturns and periods of stagnation and we’re in one of those and have been for the last couple of years.’”

💡”Until the stock market encounters what looks like a traditional recession, stocks are free to go,” Jeff said. “If everybody thinks that everybody else thinks that stocks can go higher forever, then they can go higher forever. It doesn't really encounter a problem until they're forced to liquidate by some financial event or something else.”

We’ve Been Going Sideways for More Than 2 Years

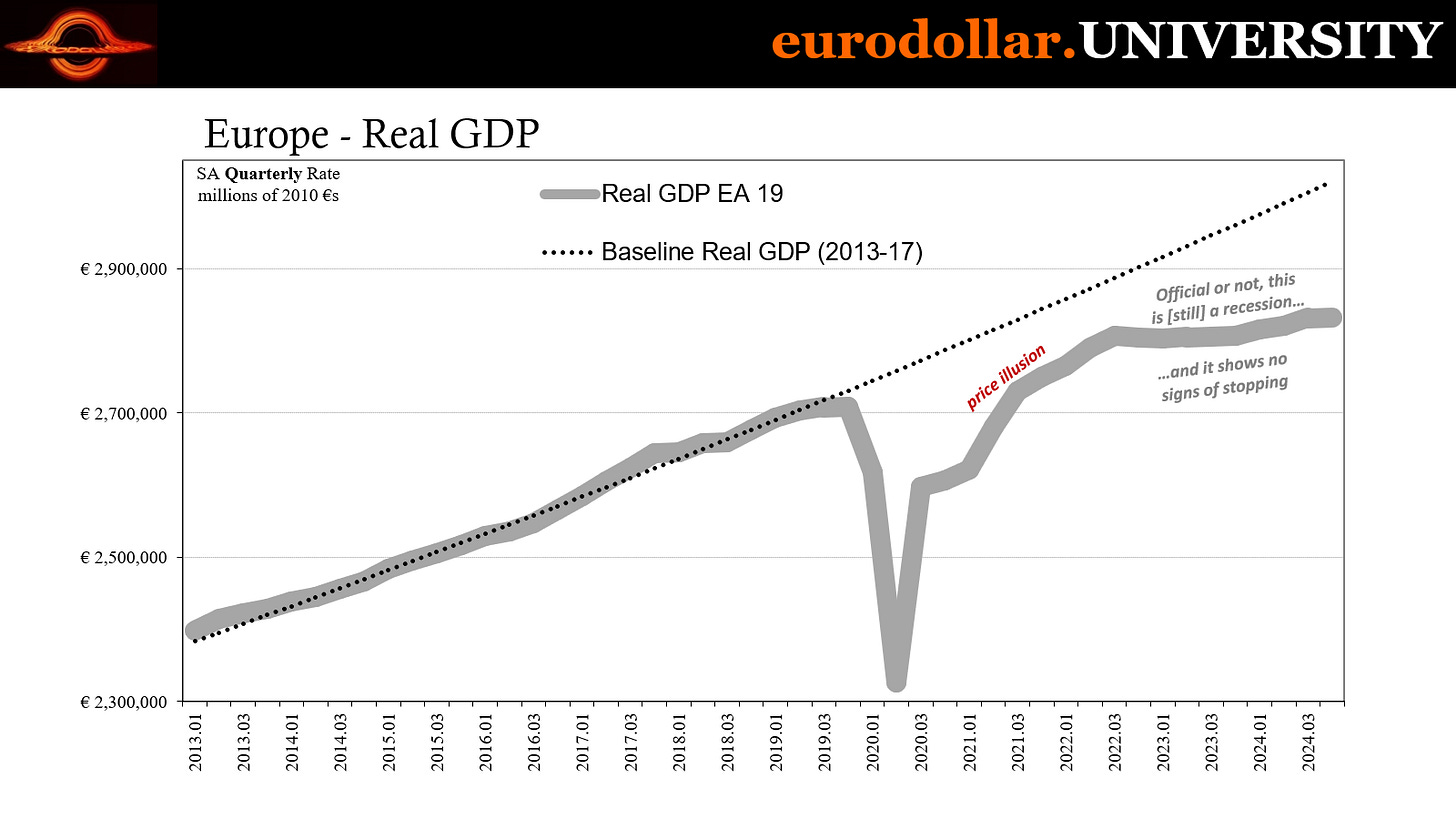

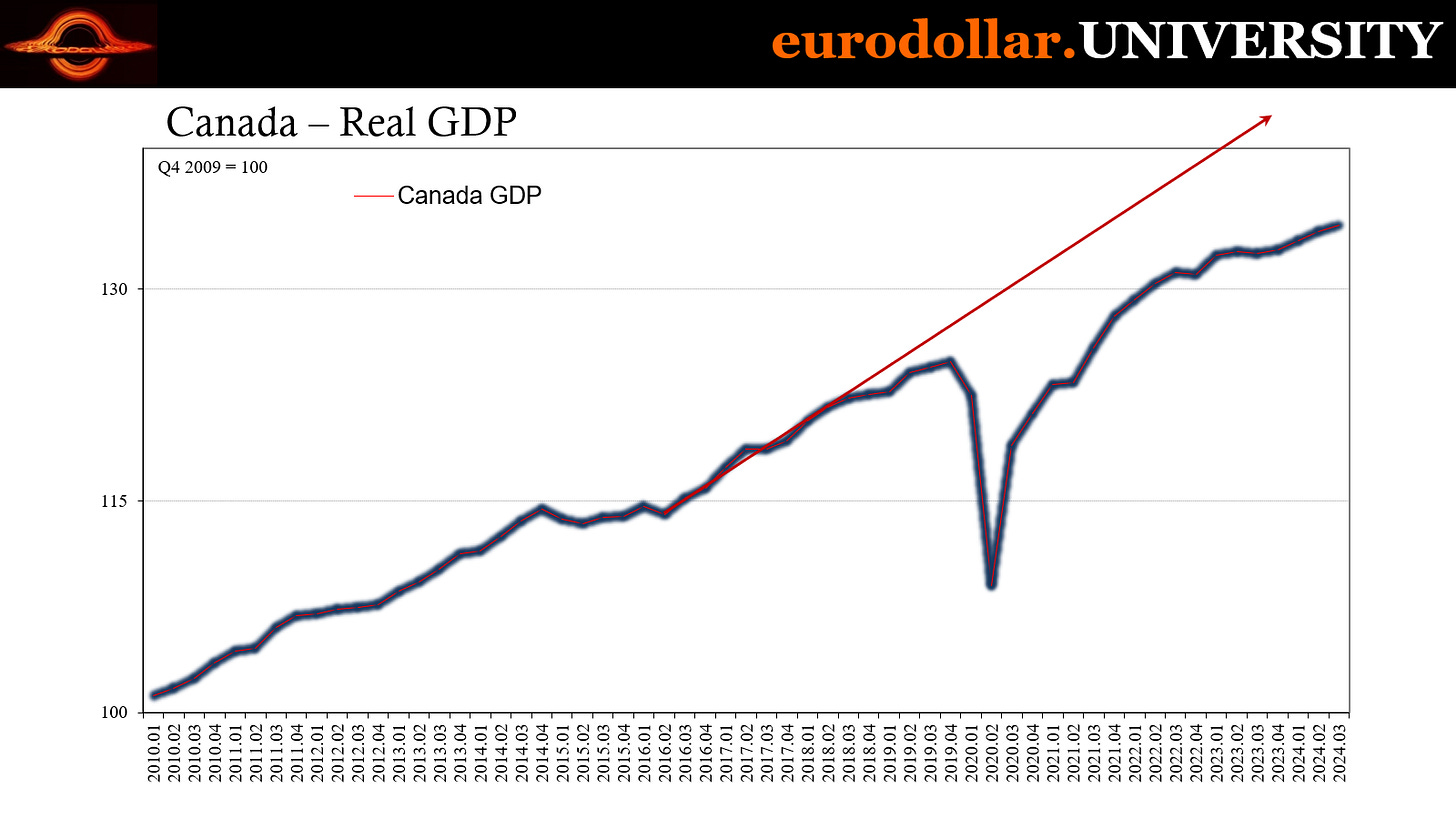

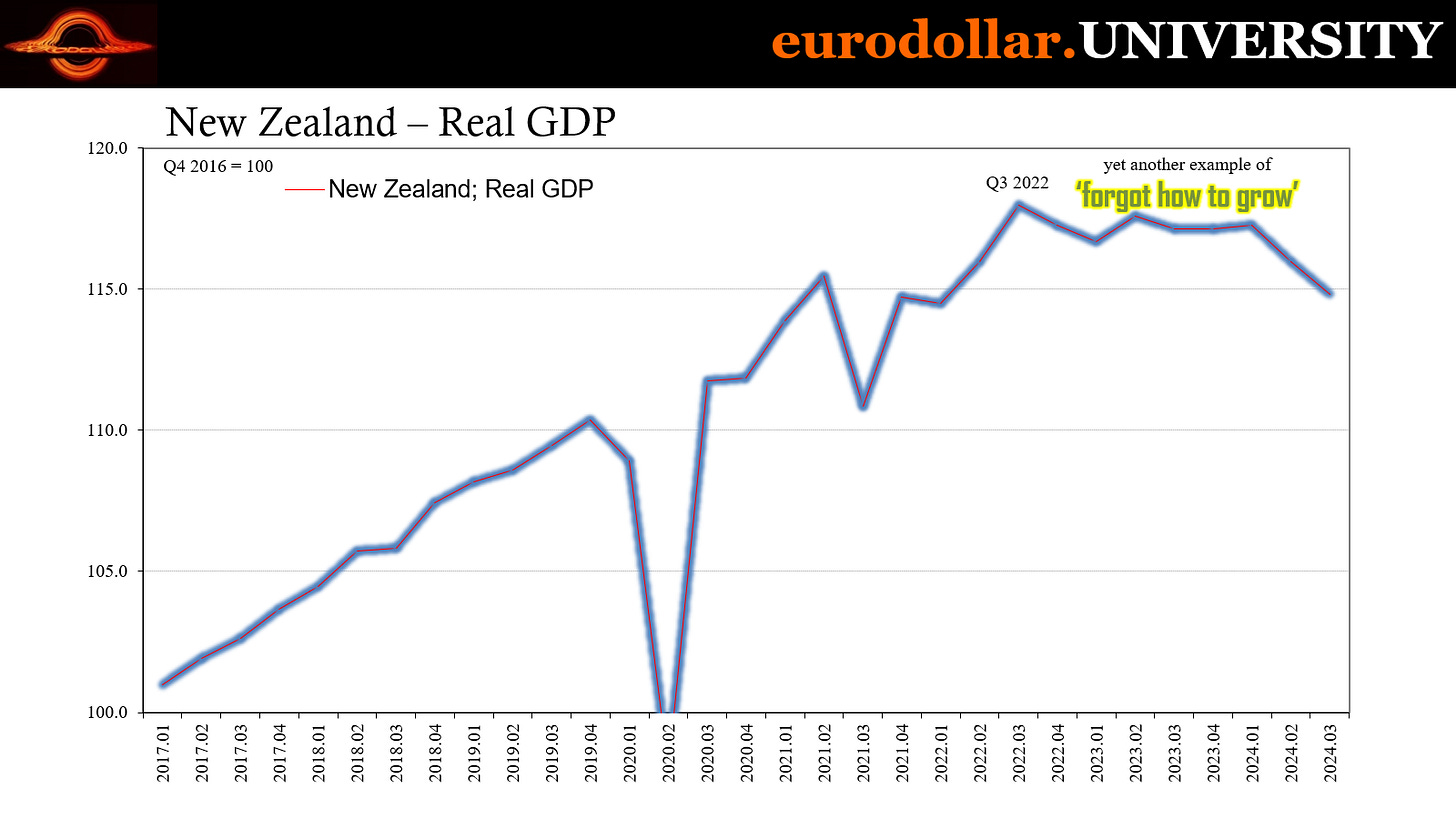

“People think recession looks like the recession we’re used to in the post-war era up until 2007,” Jeff said. “But what we've seen for the macro economy, especially outside the United States where this pattern is much clearer, essentially the economies stopped growing back in 2022. In real terms, when you adjust for prices, volumes just stopped. And so it's been sideways for two and a half years, going on three years in a lot of places.”

Some receipts… (More here.)

“You see the sideways trend almost everywhere,” Jeff said. “It goes back and forth in short run variations, but overall it goes nowhere. And what people miss about that is that when you go nowhere for more than two years, that's an enormous contraction all its own.”

How We Got Here

We’ve had a “very unique set of circumstances in the 2020s” so far said Jeff, citing the pandemic, lockdowns, the supply shock, government transfer payments, and the effects of the Inflation Reduction Act. “All that stuff happened in a relatively short period of time and it created massive distortions all throughout the economy, that make it largely unrecognizable and therefore not really comparable to historical periods.”

So, the uniqueness of the 2020s so far has a lot to do with it - or at least has a lot to do with why we’re in uncharted territory. But Jeff says the root cause goes back further than that.

“This goes back to 2008,” he said. “We've never recovered from that one. The entire decade of the 2010s was more sideways stuff. It didn't look like a traditional recession, it didn't have lots of negative numbers, but you had way too low levels of growth.”

So, Jeff says, the sideways action of the last couple of years is really just a return to the 2010s sideways norm, before the 2020s came along and whacked us over the head.

Political Consequences

There are political consequences to this low growth, Jeff said. “Why are we seeing government after government replaced?” he asked, pointing to the UK, New Zealand, US, as just a few examples.

“People realize, even if they don’t the macroeconomic stats or see GDP go sideways, they can feel the results of that. They can feel it even more this time because they know they've been impoverished. You had the 2010s economy and then you impoverish everybody by the price changes that happened in the early part of this decade… You can't just impoverish people and expect it to go well.”

Sure, economies didn’t fall off in terms of output, but they “did fall off in terms of purchasing power of consumers and businesses,” Jeff said. “And that’s what they’re p*ssed about. They can feel the weakness in the economy and they know they've been closed off from any chance of being made whole. And they're taking their anger out on politicians who refuse to admit the truth here.”

💡“Deglobalization is a symptom of the fact that the economy stopped growing in 2008,” he said. “[The thinking is] ‘if the rising tide is not lifting every boat, then let’s just look at home first.’”

The Monetary System is Borked, Too

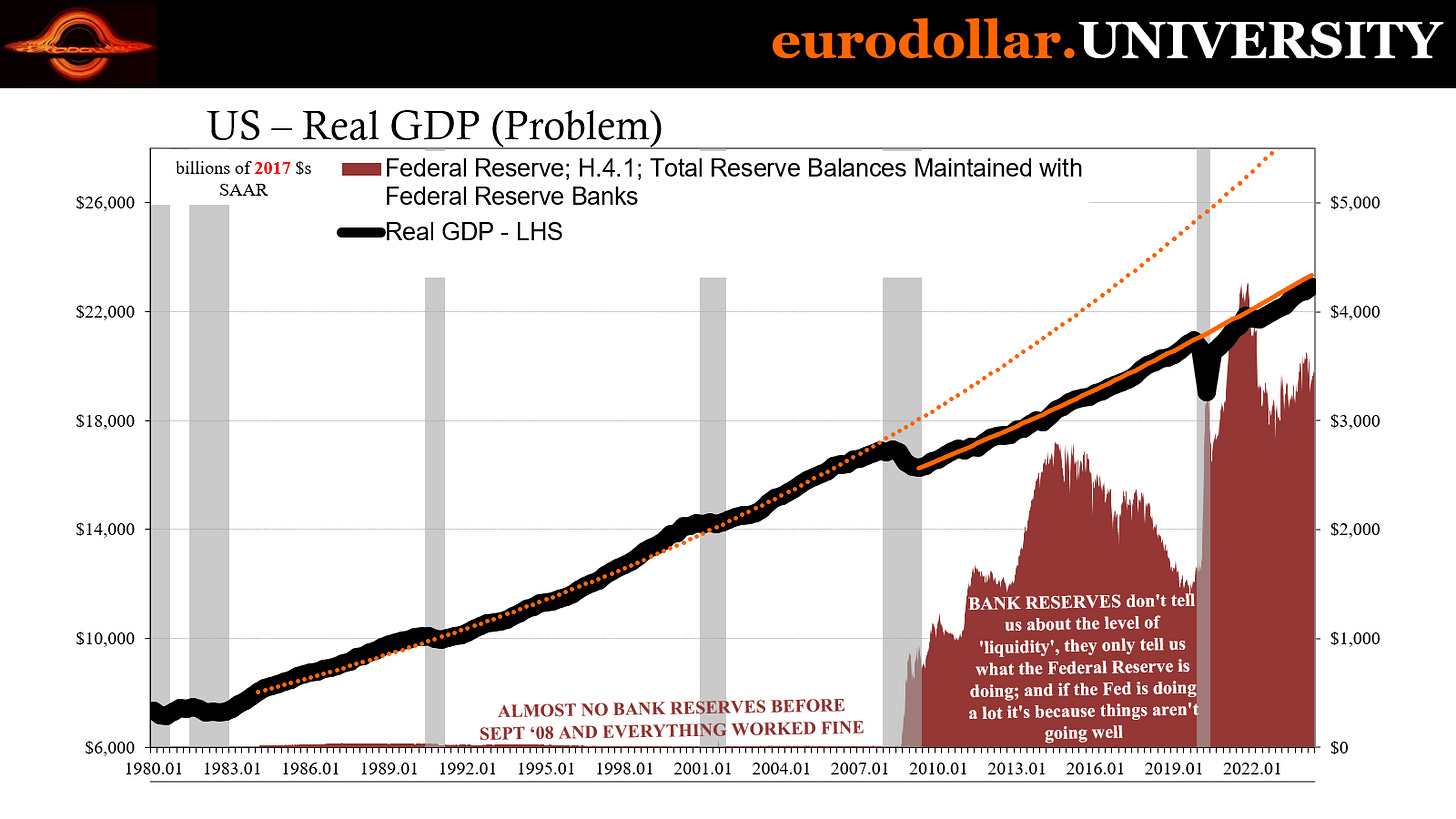

Much like the current economic problems being rooted in problems from 2007/2008 that were never fixed, the monetary system has been basically kaput since then too, Jeff said.

“We have a monetary system that broke down in August of 2007 and it’s never been fixed,” he said. “And nobody even knows it’s broken because everybody’s been dazzled by QE and Fed policies and fiscal stimulus and everything else. And so nobody has stopped to look at the original sin.”

Essentially, he says, money just doesn’t flow anymore, which is an issue that is almost deserving of “YOU HAD ONE JOB” for an intermediation system like banks.

“When they're functioning and they're functioning well, you have the credit creation and intermediation that allows credit and money to flow everywhere that it needs to flow,” Jeff said. “But if you don't have a functioning intermediation system, then you've got funds that are trapped over here doing nothing. So instead they'll just buy safe and liquid government bonds when they could really be used over here to finance a productive activity like building a factory or hiring a bunch of workers.”

And that means “you’re now financing governments who feel they have to do more. And let’s face it, governments are absolutely awful at trying to allocate resources. So you get locked in this perpetual Japanification where nothing seems to work because we still haven’t solved the original problem.”

Is There a Fix?

Well, Jeff doesn’t think the genie can go back in the bottle when it comes to banks. “The problem is the banks don’t operate the way they used to because they’ve seen what they can no longer unsee… Before 2008, everyone assumed that risks were incredibly low, that the adoption of quantitative techniques [had abstracted risk away],” Jeff said. “[But] we can’t remove the human element, that greed and the ability to rationalize and fool ourselves. So you’re always going to get into a bubble type of end state.”

The “bubble end state” is necessarily followed by a reset and reform… except in this case, it hasn’t. “We never reformed,” Jeff said. “The Fed and the ECB and everybody threw a bunch of QE at it, and kept trying to go back to the way things were rather than realizing they need to reset and start all over again.”

Jeff says that digital currencies “were a response to this monetary need.” “The Eurodollar system doesn’t provide the same capacity it used to, and so you have this organic free market process that has sprung up,” he said. “Stablecoins are in many ways an extension of the Eurodollar system into the digital age.”

Now, this isn’t some idealistic view of digital currencies. Some key points Jeff made:

This isn’t really new: “We’ve been moving toward a ledger money system for hundreds of years… We’ve been moving into more flexible mediums than store-of-value money because in a dynamic specialized economy, you need money to be mobile.”

It’s not enough: “Stablecoins are an extension of the existing system into a new format. A stablecoin is really nothing more than a money market fund with a tradable token attached to it. In many ways, to me, they don’t represent enough of a step in evolution.”

It needs regulation: “If you talk to anybody in the [stablecoin] business, their primary complaint isn't necessarily regulation. It's the lack of regulation because a lot of stable coins are junk. There's a lot of scams out there, which is true of any disruptive technology… But there are a lot of honest stablecoin projects out there who are really attempting to solve these very big issues.”

But it has already had positive benefits: “It's been able to get into parts of the global economy that had been frozen out in the current Eurodollar malfunction era…. Places in Africa and Southeast Asia where stablecoin adoption is really flourishing.”

And it’s better as a currency than Bitcoin: “Bitcoin’s price is a huge impediment to adoption as a payment medium because you can’t trust the price.”

The 64 million stablecoin(!) question is “whether or not these can be scalable fast enough to create more of a better alternative and a legitimate alternative to the current arrangement,” Jeff said.

In the meantime, get your seatbelt on for more volatility…

To watch the full episode, right this way.

Enjoy,

Maggie

Important Disclaimer: It is crucial to remember that this article is for informational purposes only and should not be considered investment advice. Consult with a qualified financial advisor to assess your risk tolerance, investment goals, and determine if an allocation to oil aligns with your overall financial plan.